2 Artificial Intelligence (AI) Semiconductor Stocks That Could Join Nvidia in the $1 Trillion Club

Nvidia (NASDAQ: NVDA) has emerged as the dominant force in the AI data center chip industry. As big tech ramps up spending on new artificial intelligence (AI) models, Nvidia’s cutting-edge graphics processing units (GPUs) have been critical to their needs for rapid computational power.

Nvidia commands an estimated 80% of the AI chip market. As a result, its stock price has rocketed higher — joining the $1 trillion club last summer when it touched $3 trillion in market value on June 5. Among the few companies with market caps of $1 trillion or more, it’s the only one exclusively focused on semiconductors.

Yet, two other semiconductor companies benefiting from the current AI trend could soon join Nvidia in that upper echelon of mega-cap stocks. Helped by several growth drivers beyond AI, they could have a lot of staying power once they get into the $1 trillion club.

1. Taiwan Semiconductor Manufacturing

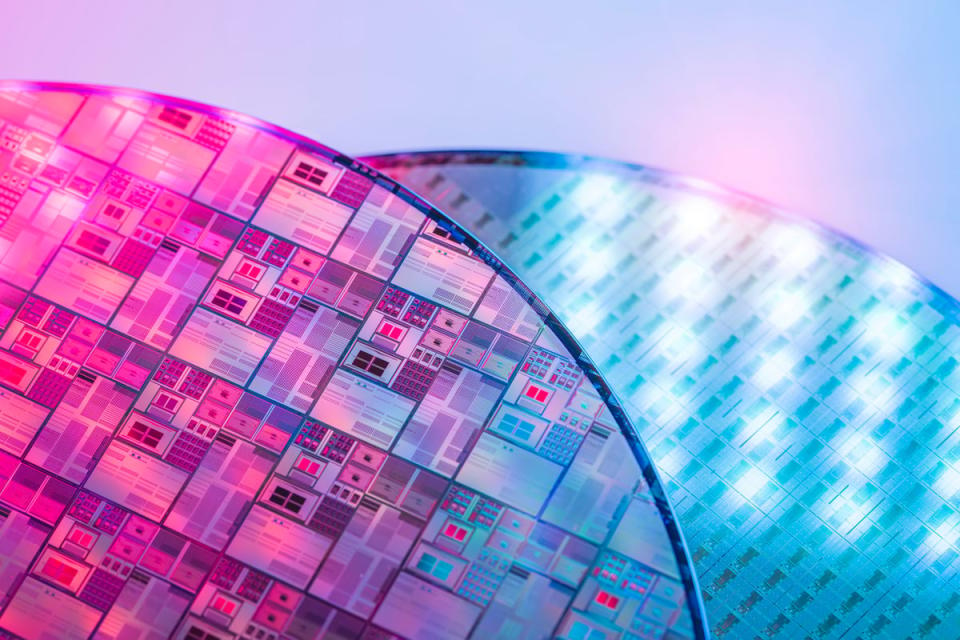

Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC, is the largest semiconductor foundry in the world. Most semiconductor companies today don’t manufacture the chips they design. Companies like Nvidia contract out that process to fabrication specialists like TSMC.

TSMC takes on big capital expenditures and engineering R&D expenses to build out factories capable of printing ever-faster, more powerful, and more energy-efficient chips — and it makes more of them than anyone else. This has created a virtuous cycle: Because it offers leading-edge capabilities, it receives more business from chip designers. The profits those deals bring in allow it to reinvest more into the next generations of manufacturing processes.

Since TSMC’s processes can be applied to semiconductors for all sorts of applications, the foundry is not reliant on any specific case like artificial intelligence to support demand for its services. Instead, the never-ending march toward faster and more power-efficient computing drives demand for its manufacturing capacity.

That said, AI has certainly been a catalyst for TSMC recently. Management has forecast that its AI-related revenue with grow at a compound annual rate of 50% over the next five years. By 2028, it believes AI chips will account for more than 20% of its total business.

With AI fueling growth for TSMC, analysts expect it to grow its bottom line at an annualized rate of more than 20% for the next five years. While that won’t match the eye-popping recent growth of some chip designers like Nvidia, TSMC is in a far more predictable and stable business, as it services a much wider customer base. Its forward P/E ratio of 26.5 is a fair price to pay for the stock.

Its market cap currently sits around $685 billion. It would have to climb by about 46% to reach the $1 trillion milestone, which probably won’t happen in the near term. But TSMC’s steady growth makes it a shoo-in to hit that mark in the long term. And based on management’s expectations for growing AI-related revenue, “the long term” may only be a couple of years.

2. Broadcom

Broadcom (NASDAQ: AVGO) is one of the biggest chipmakers in the world, with a broad portfolio of designs for various end markets. AI has been a driving force for its results lately — its AI revenue quadrupled year over year during the company’s fiscal 2024 first quarter.

Broadcom builds AI chips with a focus on overcoming the networking challenges involved in moving around large amounts of data. As AI data center clusters grow, it becomes increasingly important to ensure data can move quickly and efficiently from one processor to another. That enables big tech companies to get the most out of the expensive GPUs they spent billions of dollars on acquiring or developing. As the size of these networks grows, demand for Broadcom’s chips could expand exponentially.

But its semiconductor business is diversified beyond AI. It also makes chips for smartphones, broadband access, and data storage. It produces best-in-class networking chips for smartphones and broadband that require advanced engineering capabilities, which have helped it win majority shares of the markets in which it operates. That leads to a virtuous cycle, enabling it to reinvest in R&D to improve its products and stay ahead of its competitors. The company spent more than $5 billion on R&D last year.

Broadcom also has a software business that includes the recently acquired VMWare. The VMWare deal cemented its position in virtualization and mainframe software, which complement software for security, DevOps, and more. It often manages to win sales for multiple solutions — 80% of its customers use five or more of its services.

AI should fuel strong growth for Broadcom over the next few years as big tech continues to spend heavily on data centers. With its existing wireless, networking, and software businesses, it is building off a steady base. That should support strong growth, and margins should move higher after it fully incorporates VMWare.

Broadcom shares currently trade at around 30 times forward earnings. That valuation should be supported by strong growth over the next five years. Based on its current market cap of $650 billion, Broadcom looks poised to join the $1 trillion club within that time frame.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Adam Levy has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Semiconductor Stocks That Could Join Nvidia in the $1 Trillion Club was originally published by The Motley Fool