Michael Vi/iStock Editorial via Getty Images

Dear subscribers,

I don’t often provide articles on semiconductor companies, and it has, in fact, been some time since I reviewed the former Siemens company Infineon (OTCQX:IFNNY). However, I believe the time has come to do exactly that, given that the company trades at a sub-15x P/E. My last article on the company was back in 2022, around 1.5 years ago, and you can find that article here.

This is not a high-yielding business, nor is it ever likely to be. These semi-businesses very rarely are. However, that doesn’t mean that this is not investable as a company – and I have a small stake in Infineon. I’m hoping that I will be able to expand it this year and take advantage of what I view as being a multi-year cycle upside for Infineon for the next few years.

In this article, I’ll share with you why I believe this to be the case, and what I consider to be a good point for entering Infineon beyond a watchlist position – which is where I currently am.

In this article, we’ll take a look at what Infineon does, what it is, where its exposures lie, its risks and upsides, and a bit of what you could expect from the company in the next few years.

Why, simply put, I am putting money to work here.

Let’s get going.

Infineon – Why the company has upside

So, looking at the semiconductor market – because my last article on this company was years ago and doesn’t hold much relevance any longer, I would say that Infineon as of 2024 has a very competitive position.

It’s valid to call Infineon “broad-based” in terms of what it does. Infineon is a chipmaker, and like many chipmakers, its exposures lie in things like the industrial automotive and related sectors. The company has been working, over the past few years, to increase its exposure to EVs and become a leading supplier in all things chips to these vehicles. Given the amount of chips being used, this is no small or unattractive thing.

Infineon has recently been increasing its car infotainment exposure.

This also brings us to the “problem” with Infineon. Anything exposed to automotive or industrial is going to be cyclical in demand. Infineon is no different. So despite a breadth of business with many end markets, there’s plenty of volatility in the company’s earnings.

We can focus on the automotive chip market for a bit – since this is a large area of where the company’s exposures lie. Any vehicle with an advanced powertrain is going to be housing a multitude of chips related to the many dozens of systems within the vehicle. The power voltage chips, sensors and other products are supplied by companies like Infineon.

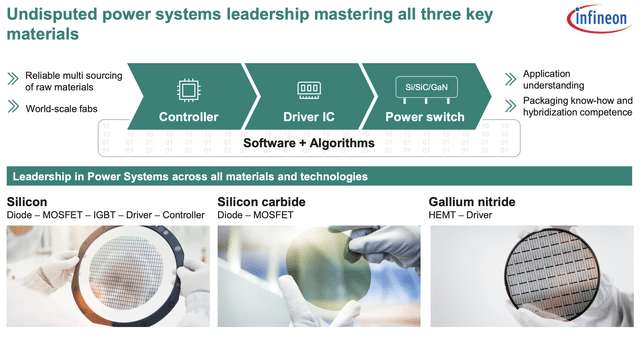

These are known as SiC-based semiconductors (silicon carbide), which due to their use have tolerance for higher voltages and are crucial in improving range and efficiency in electric vehicles. This is why these things are in very high demand.

Infineon, as such, focuses on power semiconductors.

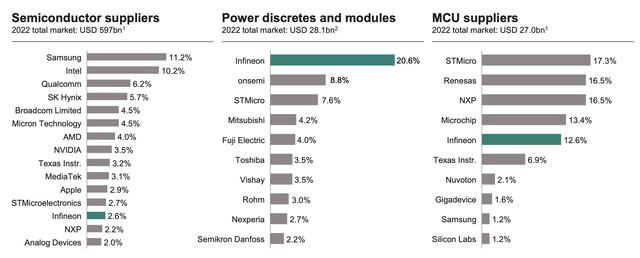

But it’s hardly the only company that does this – so it faces a lot of competition. Some to consider are ON Semiconductor, Texas Instruments (TXN), and STMicroelectronics (STM). Which one is the best choice here – well, I obviously think Infineon has a lot to bring to the table – even though Texas is by far the largest player here with a market cap that is 3x+ that of Infineon.

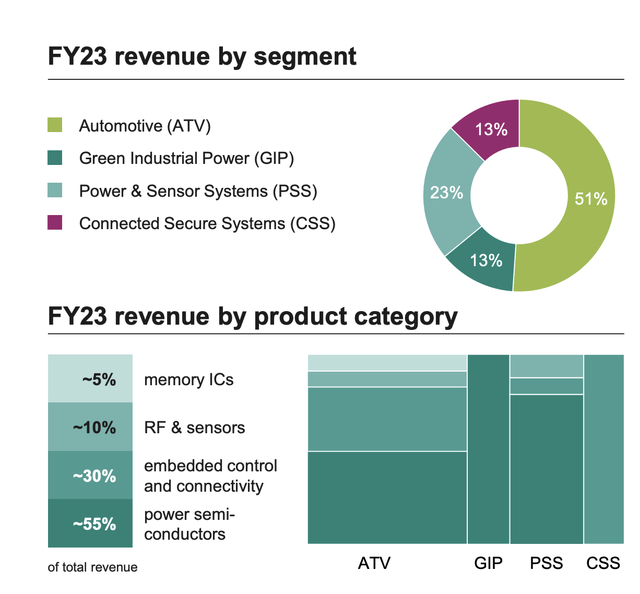

If we were to summarize Infineon by three markets or things that it tries to excel in, it’s Energy, Mobility, and IoT. The company has an interesting mix of products, but is 50%+ automotive exposed.

The company’s financials have been improving year-over-year for almost 10 years at this point, with margins going from 17% in 2017 to 27% in 2024 – a very impressive journey, with segment results more than tripling.

Infineon is also ranked very high on a global scale, and is in fact by far the leader in power discrete and modules – even if it lags other companies mostly anywhere else. Note that these numbers are 2022-based, though.

The largest end-markets, in this order, are E-mobility, renewables, ADAS, IoT, and AI/Data Center, coming to over 30% in total. This is an attractive subset of segments, which has also led to the company becoming a primary partner for companies like BYD and Honda (HMC). Its leadership in these things of power systems is, in fact, completely undisputed.

This is enough for me to make the company fundamentally interesting as an investment, let alone that it also provides top-line sales growth of double digits on average, with a segment result margin that now is above 22-23%, with a 10-15% adjusted FCF margin. This leaves ample room for further growth.

The company is also very clear in its goal that double-digit growth is, in fact, ahead of it. This is targeted through margin expansion in the cycle, coming from an upside in pricing, better mix, scale effects from 300mm production, better OpEx scaling and FX, weighing up increased costs as well as CapEx.

The company also expects the FY24 revenues to increase to around €16B, with a slight lowering in the result margins, and gross margins. The dip we’re going to see comes from a downcycle as well as higher investments and some D&A, including some purchase price allocations.

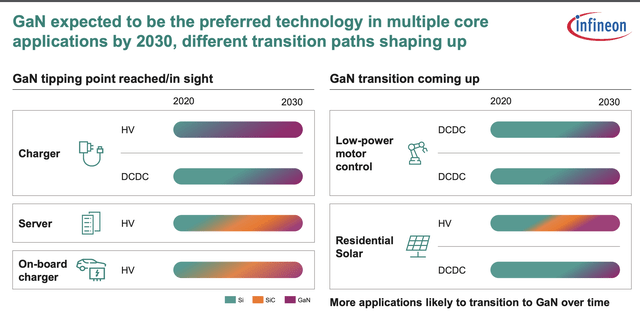

The company is also putting a lot of faith in GaN technology.

What is this?

Gallium Nitride chargers are about 3x the efficiency of silicon-based chargers in converting power to electricity, as well as being smaller and more portable. This means that they can charge your phone ten times faster than a regular charger. They’re also far more resistant to temperatures. This will increase the possibility of producing more powerful devices while using less energy in the future.

The one obvious, and likely expected, drawback is that production costs for GaN are currently expensive – but Infineon is focusing more on this. So one of the reasons I’m moving into Infineon is, in fact, the GaN tech exposure, where the company seems like a leader.

At current estimates, we’re talking about a 2022-2027 GaN CAGR of 56% or a $6B market in less than 5 years.

So, plenty to like here.

Infineon is also BBB+ rated and has extremely low debt, coming to long-term debt to capital of 25.4%.

What are the risks and upsides to the company here as we’re looking to potentially invest?

Let’s see.

Risks & Upsides to Infineon

The obvious one, we’ve already discussed a bit. It’s the cyclicality of the company’s sectors and end markets, which in turn makes Infineon cyclical, which we’ll see in the next year or so.

What else?

Unlike some US-based competitors, such as TXN, the company’s business is perhaps more commoditized, which in turn explains the company’s lower gross margins. Infineon is a great business, and it does lead in a key segment, but that does not make it “as good” in terms of high-performance analog chips, which is what other companies do better.

Also, Infineon has a relatively high exposure to the Euro – and the eurozone as a whole. I don’t view this as a net positive in risk, though this could go a bit of both ways.

Positives?

We’re talking about an increased focus on the core – mobility, power, card security, and other ancillary businesses. This is after streamlining large parts of the company and divesting underperforming units. The company is capable of making such strong moves, and as a result of this, is in a better position to outperform.

Also, given that Infineon is moving into GaN and has a long expertise of building power-efficient chips, in a world where people are seeking better charging and energy efficiency, I expect the company to outperform on this basis alone.

Let’s look at company valuation.

Infineon Valuation – Plenty to like – a 15%+ annualized upside

So, let me be clear from the get-go. I view Infineon as a company with a “BUY”, but perhaps more in the longer term. It’s not unlikely that we’ll see a double-digit drop for this company here, coming to around €2/share for the 2024E period.

However, beyond that, I expect the company to grow by double digits – as does the market, and as do analysts (Source: FactSet) If this materializes, the company is likely to see a 15%+ annualized upside here from this – and beyond.

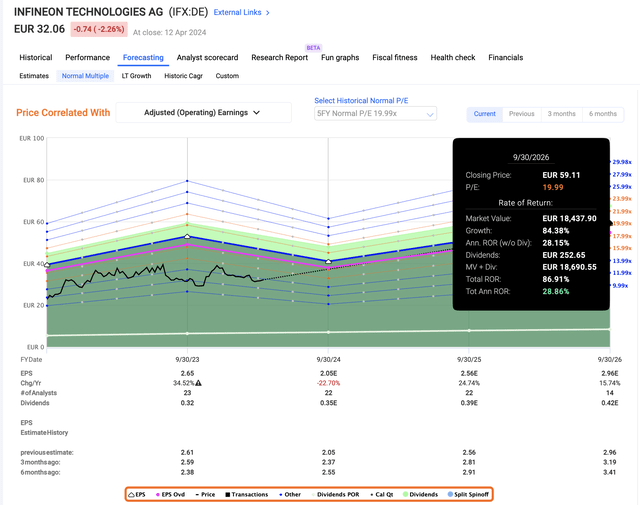

Infineon typically trades at around 20x P/E. If the company maintains this for the next few years, this is what you can expect.

Infineon Upside (F.A.S.T. Graphs)

As you can see, almost 30% annualized is not unlikely there. And even at 15-16x, the upside is 15% annualized – and more. Almost 18%, with an implied share price of almost €48/share. (Source: FactSet)

What I would do is put the 15% annualized share price as a PT here, which comes to around €45/share.

Buying Infineon, I would focus on the native German ticker IFX, which currently trades at €32/share, but which is followed in turn by 22 analysts (Source: S&P Global). You know where I see the upside to this company. These 22 analysts consider the company a “BUY” with 20 out of 22 at either a “BUY” or “Outperform” rating for the business.

That’s a high vote of confidence, and one I completely agree with, by the way. The lowest PT given is €35, and the highest around €54/share. And frankly, as far as these targets go, I would consider that range in the bearish and bullish sense to be pretty realistic. (Source: FactSet)

I’m in no hurry to invest here. I believe the downturn in semis will see Infineon move lower – perhaps even below €30/share. But once it does, I will be allocating capital to Infineon, and expecting a double-digit rate of return on a forward basis.

Here is my current thesis for Infineon.

Thesis

- Infineon is one of the world’s primary semiconductor companies. Its current yield is sub-par of that we see in the risk-free rate, but its fundamentals and 5-year potential, as I see it, is worth your investment here. I believe Infineon with a BBB+ credit rating and its current attractive business mix is likely to outperform.

- Conservatively speaking, I’m seeing a price target of around €45/share for the long term. This gives the company a “BUY” from me here, and an upside of at least 15% annualized.

- I believe we should be careful getting exposure here given the likely downward trend of the company, but we can get ready to buy shares here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I do not view the company as currently being cheap, though it’s not far from it – but it does fulfill every other one of my criteria. Based on this, I give the company a “BUY”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.