Sundry Photography

I wrote my last article on Lam Research (NASDAQ:LRCX), titled Lam Research: An Opportune Moment To Add The Stock, on Oct. 10, 2023, with a buy recommendation. Since then, the stock has been up around 66% compared to the S&P 500 index’s rise of 26%. Although the stock has made a significant move over the last eight months, there is still a lot of potential upside left.

Lam is a Wafer Fabrication Equipment (“WFE”) company. The WFE industry had a severe cyclical downturn in the first half of 2023. When I rated the company a buy last October, it looked like WFE spending was bouncing off a possible bottom. Zacks published an article in April of this year that cited information from SEMI (emphasis added):

According to SEMI, capex spending will accelerate this year [2024] despite the softening in auto and industrial markets that is keeping analog [chip] makers under pressure. The firm expects 2024 to be a transition year followed by a strong rebound in 2025, driven by capacity expansion, new fab projects and high demand for advanced technologies and solutions across front-end and back-end operations. Overall, WFE sales are projected to increase 3% in 2024 and 18% in 2025.

Transition year is another way of saying that SEMI expected WFE spending to be weak in the first half of 2024 and pick up sometime in the second half. Lam’s stock has already made a significant move higher since the latter part of 2023 based on anticipation of the WFE spending coming off a bottom, especially in memory. The stock will likely continue moving higher as there is more confirmation that a robust rebound will occur in 2025. On June 26, Micron Technology’s (MU) Chief Executive Officer (“CEO”) said during the company’s earnings call, “We expect to increase our capital spending materially next year, with CapEx [capital expenditures] around mid-30%s range of revenue for fiscal 2025.” That statement is excellent news, as Micron, a memory chip manufacturer, is one of Lam’s customers. Micron spending more in CapEx is a potential sign of a strong rebound in WFE memory applications in 2025 and should translate into revenue growth for Lam next year.

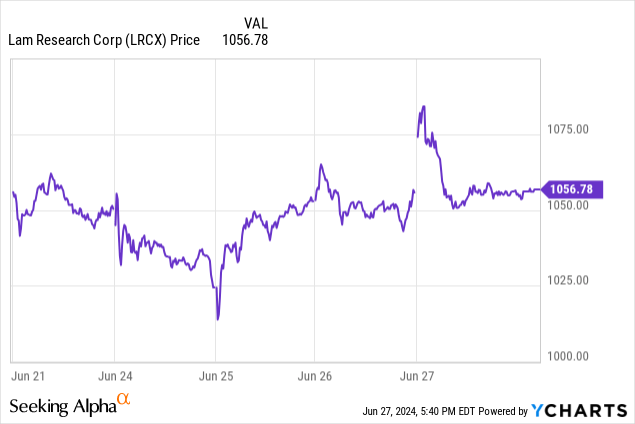

Although the stock price retreated from early highs, the following chart shows investors’ immediate reaction to the Micron news as the stock price gapped up on June 27. The market is itching to bid Lam’s stock up on any news confirming WFE demand is increasing, particularly in memory chip applications like NAND, a type of memory chip which can retain data even when the power is off, and DRAM, a kind of memory that temporarily stores data.

Since we are at the beginning of July, we are officially in the back half of 2024. Suppose SEMI forecasts of WFE spending accelerating into the year-end prove true; investors should continue receiving favorable news about the demand for Lam’s equipment increasing over the next several months. With each bit of positive news, the stock should move up. So, although the stock has already risen since my last article, there could be more upside for this stock going into 2025.

This article will discuss what to expect from the company in the near term, its long-term growth drivers, and its valuation. It will also discuss a few risks and why, despite the risks, I still rate Lam a Buy.

The near-term possibilities

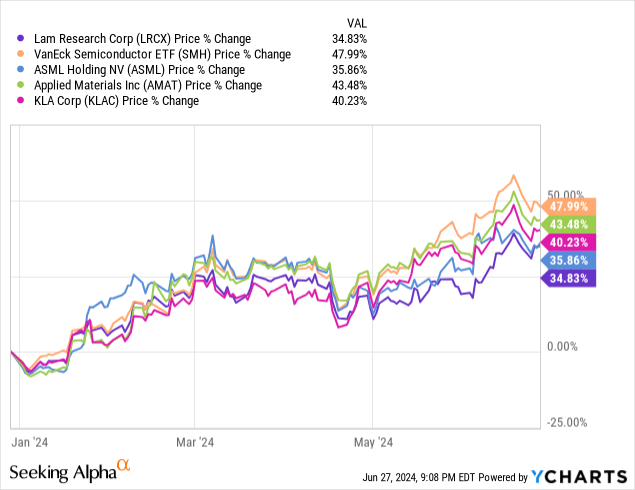

The following chart shows that Lam has lagged behind the returns of the VanEck Semiconductor ETF (SMH) and its WFE peers year-to-date.

A possible reason that Lam’s results have lagged this year is that it is the most exposed to the DRAM and NAND memory chip market out of all the publicly traded WFE companies shown in the chart above. In 2023, the memory market was hit the hardest, with the overall NAND market dropping around 37% and DRAM dropping around 38%, while the logic, analog, and discrete markets were fairly flat.

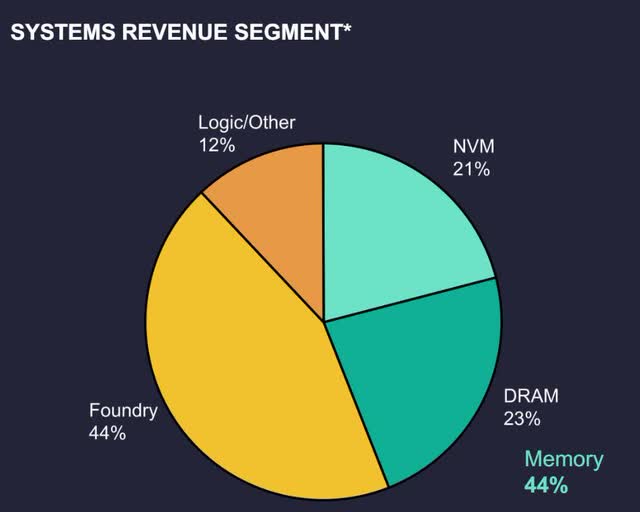

The following image shows Lam’s March 2024 system segment revenue percentages. NVM (non-volatile memory) is essentially the same thing as NAND. In March 2022, NAND was the company’s largest source of revenue at 39%, but as of the March 2024 quarter, it was only 21%. In March 2022, DRAM had 27% of revenue; in March 2024, it was 23%.

Lam Research March 2024 Investor Presentation.

The following image shows the company’s expectations for DRAM recovery in 2024. Management expects NAND to stabilize and improve in 2024, with a strong rebound in 2025. WFE spending in calendar year (“CY”) 2023 was around $93 billion. The company expects CY 2024 WFE spending in the low to mid $90 billion, a range of a slight decline to slight growth year-over-year.

Lam Research March 2024 Investor Presentation.

Semiconductor market forecaster Yole Group stated in a March 2024 article (emphasis added):

Lam’s sales dropped on lower demand for memory devices – resulting in a drop in its overall market share from 15% in 2022 to 11% in 2023. This is likely to remain little changed in 2024 but could improve in 2025, Yole Group predicts.

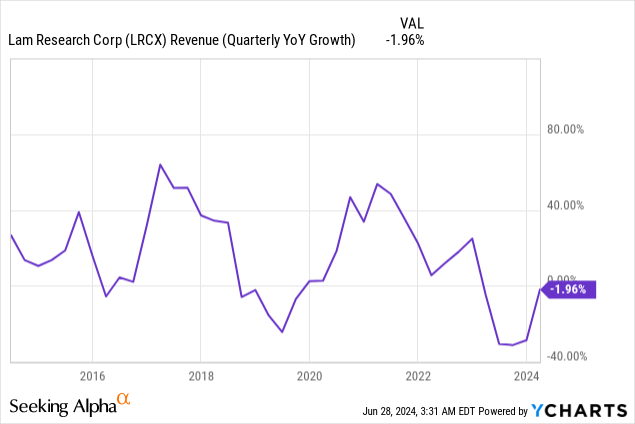

The WFE industry is cyclical. The following chart shows that Lam endured its steepest decline in 2023. In the last two cycles, quarterly year-over-year revenue growth exceeded 50% at its peak. Its March quarter 2024 revenue growth declined 2% year-over-year.

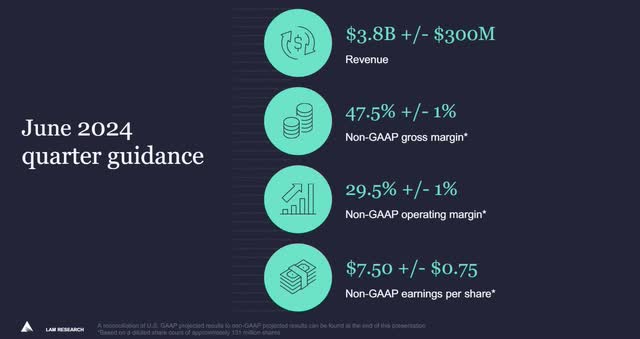

The following image shows the company’s guidance for its June quarter. The midpoint of the company’s revenue guidance was above analysts’ consensus estimates of $3.78 billion. If the company hits its revenue guidance of $3.8 billion, Lam’s June 2024 revenue growth would be up 18.4% year-over-year versus a 30.8% decline in the previous year’s quarter. Its non-GAAP (Generally Accepted Accounting Principles) earnings-per-share (“EPS”) guidance of $7.50 was above consensus analysts’ guidance for the June 2024 quarter of $7.31. If the company hits its guidance, EPS growth would be 25.4% versus a 32.2% decline from the previous year. June quarter 2024 non-GAAP gross margin guidance of 47.5% implies margin expansion of 180 basis points (“bps”) over the last year’s comparable quarter. The June quarter 2024 non-GAAP operating margin of 29.5% implies an expansion of 220 bps over the previous year’s comparable quarter. If Lam can hit these numbers, it would suggest that Lam is beginning to rebound from a WFE downcycle.

Lam Research March 2024 Investor Presentation.

Lam will likely report its June quarter in late July or early August. Pay close attention to what management says about WFE demand, especially in NAND and DRAM. Investors should also understand that the stock could move based on commentary from Lam’s top customers, including Taiwan Semiconductor Manufacturing Company (TSM), Samsung, Intel Corporation (INTC), and Micron. Commentary from those customers about an increase in future CapEx spending to buy WFE could move the stock price higher as that news could imply potential future revenue increases for Lam. The market often anticipates revenue increases and could bid the stock up before you see actual revenue increases in Lam’s earnings reports.

Long-term growth drivers

Lam Research March 2024 Investor Presentation.

The adoption of new technology such as Artificial Intelligence (“AI”), self-driving cars, mobile devices, high-performance computing, and edge computing drives the need for smaller, high-performance, and more power-efficient chips. Manufacturing these better chips requires new techniques, architecture, and materials.

The company’s Chief Financial Officer (“CFO”) Doug Bettinger said on the second quarter 2024 earnings call (emphasis added):

2024 is a year of continued transformation for Lam Research. We’re investing in our long-term strategy to extend our technology leadership and operational excellence while efficiently managing overall spending. We’re encouraged that the long-term drivers of semiconductor growth, such as artificial intelligence, are seeing accelerated adoption. And we expect Lam to be a strong beneficiary of these trends. We are well-positioned for the architectural and material change coming, such as gate-all-around, advanced packaging, backside power delivery, and the move to dry photoresist.

Lam often benefits when chip architecture or the materials used to make the chips change. CFO Bettinger gave an example of what an architectural change can do for the company when he said during the Bank of America Securities 2024 Global Technology Conference, “When things go 3D, like NAND did a decade ago, our addressable market doubled for wafer.” NAND memory manufacturers started stacking memory cells vertically on top of each other to fit more cells on a single chip, and manufacturers named this new architecture 3D NAND. When manufacturers shifted to this new architecture, it opened up Lam’s opportunity for more revenue by doubling the company’s total addressable market. The company’s core competencies enabled chip manufacturers to build 3D NAND chips.

Gate-all-around, advanced packaging, backside power delivery, and dry photoresist all involve either architectural change, a change in materials, or both. For instance, Gate-all-around (“GAA”) is an architectural change to logic chips that opens up more opportunities for Lam. GAA is an upgrade from the previous FinFET technology used for logic chips. Because GAA requires advanced deposition techniques, and LAM is the number two player in deposition, the shift towards GAA should help improve the company’s revenue gains from logic.

Advanced packaging is a way to bring multiple functionalities into one chip. Usually, when people refer to advanced packaging, they mean using it in concert with another technology named chiplets. Lam Research gives an example on one of its blogs: “Advanced packaging might join logic chips, central processing units (CPU), graphical processing units (GPU), radio frequency (“RF”) chips, and memory onto a single chip.” The benefit of advanced packaging is that it can reduce a system’s size and power consumption. Advanced packaging involves using new materials, and chiplets are a new architectural change. In November 2022, Lam acquired SEMSYSCO GmbH, improving its advanced packaging capabilities.

Backside power delivery is another way to improve a chip’s power and performance. Because it requires additional features on the chip’s backside, it may require specialized etch techniques, and Lam is a leader in these techniques. This new chip feature is an architectural change and may involve new materials.

Dry photoresist for EUV (extreme ultraviolet) helps chip manufacturers make smaller DRAM and logic chips. Lam collaborated with ASML Holding (ASML) and Imec to develop a dry photoresist. This technique involves a change in materials. Richard Wise, general manager of the dry resist product group at Lam, said (emphasis added):

Lam’s dry resist technology is a game-changer. By innovating at the material level, it addresses EUV lithography’s biggest challenges, enabling cost-effective scaling for advanced memory and logic.

Lam’s customers are eager to adopt the above techniques to produce higher-quality chips, which should drive revenue growth. Additionally, another WFE demand growth driver is that governments worldwide, understanding the economic importance of AI, are investing heavily in local chipmaking capacity. For instance, the Semiconductor Industry Association stated the following in May:

The Semiconductor Industry Association (SIA), in partnership with the Boston Consulting Group (BCG), today released a report on the global chip supply chain that projects the United States will triple its domestic semiconductor manufacturing capacity from 2022—when the CHIPS and Science Act (CHIPS) was enacted—to 2032. The projected 203% growth is the largest projected percent increase in the world over that time.

Not to be left out, the Europeans established the European Chips Act in 2022. Multiple Asian countries, including China, Malaysia, and Singapore, are also investing in chip manufacturing capacity. The result of all these investments is that semiconductor manufacturers are increasing the number of semiconductor fabrication facilities globally. These new facilities require more WFE from companies like Lam, which is a tailwind for revenue growth.

Financial Strength

Lam Research ended the March quarter of 2024 with $5.67 billion in cash and equivalents and $4.47 billion in long-term debt. The company has a debt-to-equity ratio of 0.62, meaning it uses moderate leverage. It had a debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) ratio of 1.1. A number below 3.0 means a company can cover its debt payments with earnings.

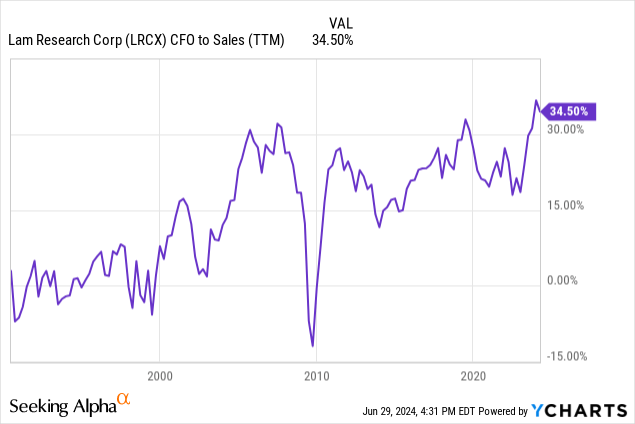

Lam has a cash flow from operations (“CFO”) to sales ratio of 34.50%, nearly the highest point in its history. This ratio means the company converts every $1 of sales into around $0.35 cash flow, which is exceptional.

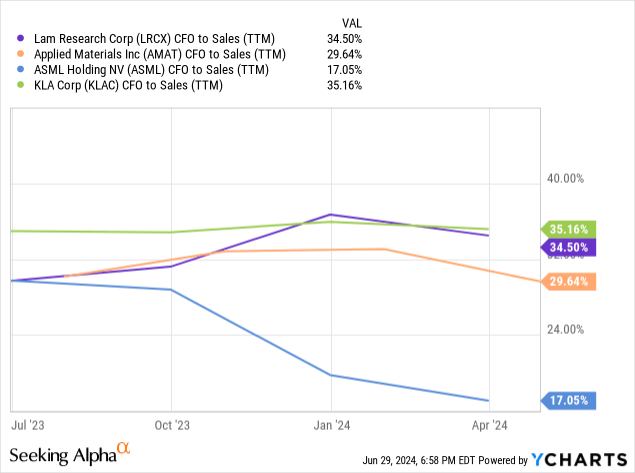

The following chart compares Lam’s CFO-to-sales ratio to a few of its WFE peers. Lam is at the top of the class, only a smidgeon behind KLA Corp. (KLAC). Generally, a company that can convert over one-third of its sales into cash has a considerable ability to invest in research and development, fund growth, pay back debt, buy back stock, and pay dividends.

The company generated free cash flow (“FCF”) of $1.281 billion in the second quarter of FY 2024. Its trailing 12-month FCF was $4.538 billion. Analysts expect Lam’s annual FCF to grow at a compound annual growth rate of 6.26% to reach $5.613 billion in 2026.

Last, let’s look at the company’s capital return. Lam’s CFO stated on the March quarter’s earnings call:

On the capital return side of things, we allocated approximately $860 million to share repurchases and we paid $263 million in dividends in the March quarter. Our share repurchase activity included both open market repurchases as well as an accelerated share repurchase [ASR] arrangement. The ASRs continued to execute into the month of April. And I would just mention, we continue to track towards our long-term capital return plans of returning 75% to 100% of our free cash flow.

The company’s share repurchases reduced the diluted share count from 135,395 in March 2023 to 131,518 in March 2024. Remember that share count reductions have implications for specific valuation ratios.

Valuation

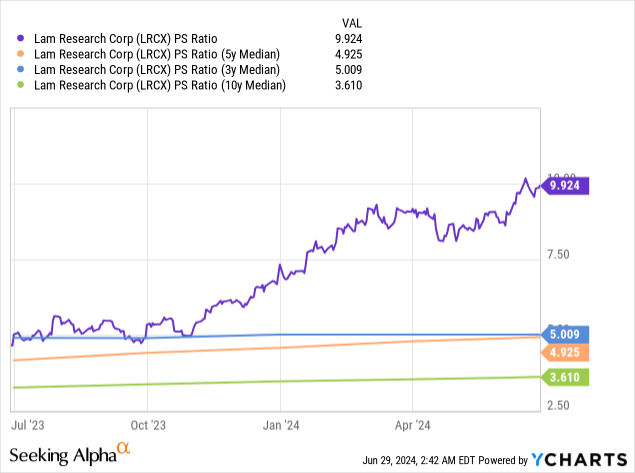

Lam has a price-to-sales (P/S) ratio of 9.924, well above its median P/S ratio for three, five, and ten years. Some might conclude that the market overvalues the stock. However, the stock price doesn’t have to go down for the company’s P/S ratio to return to its median. People calculate the P/S by dividing the market capitalization, which is the outstanding shares multiplied by the share price, by the company’s sales or revenue over the past 12 months. If Lam continues growing its sales while using its FCF to reduce the outstanding shares, it could reduce the numerator while increasing the denominator, and the PS ratio may drop without the share price necessarily dropping. It’s important to remember that sometimes “overvalued” growth stocks grow into their valuation.

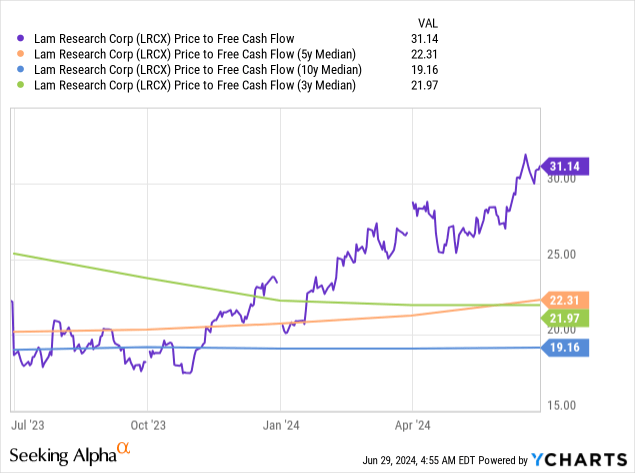

Lam price-to-FCF (P/FCF) trades above its three, five, and ten-year median. You can calculate the P/FCF by dividing the market capitalization by the FCF. As Lam’s FCF increases, the denominator increases. The market capitalization or numerator could decrease if the company uses its FCF to reduce shares. So, Lam’s P/FCF could decrease without the stock price declining. In other words, over time, Lam could grow into its P/FCF valuation.

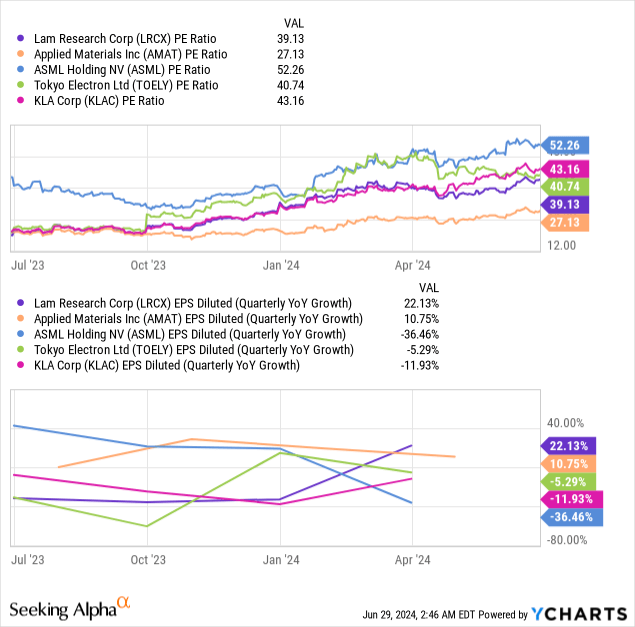

The following chart compares Lam’s price-to-earnings (P/E) ratio to several WFE peers. The company has the second lowest P/E ratio but has the top earnings-per-share (“EPS”) growth rate. Some might conclude that the market undervalues Lam on a relative P/E basis. If the stock traded at KLA Corp’s P/E of 43.16, it would be $1145.47, 8% above its closing stock price on June 28. If the stock traded at ASML Holding’s P/E of 52.26, it would be $1386.98, 30% above its June 28 closing price.

The following image shows Lam’s forward P/E ratio and analysts’ estimated EPS growth rates for the fiscal periods ending 2024, 2025, and 2026. Generally, a stock is fairly valued when analysts’ estimated EPS growth rates match the forward P/E. According to those rules, the market may overvalue the stock based on analysts’ forecasted EPS growth rates. Still, in fiscal 2026, when the WFE should be well into its upcycle, analysts’ forecasted EPS growth rate of 26.66% exceeds the forward P/E of 22.84, suggesting undervaluation. If the stock traded at a forward P/E equal to its growth rates of 27.66%, it would be $1289.50, up 21% from the June 28 closing price.

Seeking Alpha

Normally, I would do a reverse discounted cash flow (“DCF”). However, Lam is a cyclical stock, and DCF and reverse DCF can be inaccurate for cyclical stocks.

Risks

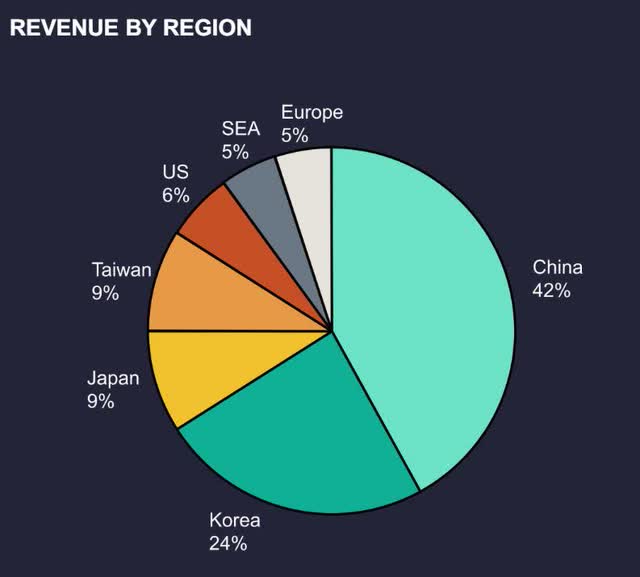

The following image shows that 75% of the company’s revenue comes from China, Korea, and Taiwan. Lam faces geopolitical risk in that region. Significant tensions between the US and China have already restricted its ability to ship some equipment to Chinese chipmakers. If the situation worsens, a substantial portion of its revenue is at risk. Additionally, Taiwan is under threat of invasion from China, and if that should happen, it could lose 9% of its revenue. South Korea has the danger of invasion from North Korea, which would severely disrupt a source of 24% of its revenue.

Lam Research March 2024 Investor Presentation.

Lam primarily manufactures tools for the deposition, etch, cleaning, and packaging processes in chip manufacturing. Although the company has a leadership position in those areas, it faces increasing competition as the industry consolidates and new regional competitors in Asia arise. Lam only has a limited number of customers. If its competitors introduce new and better products or enter a strategic partnership with one of its customers, its revenue, profitability, and cash flows could decline.

Lam Research is a buy

Lam Research has been in business since 1980. It has formed a deep relationship with its customers, which gives it an edge in understanding its customers’ project roadmaps and building specific tools to enable those roadmaps. The company will customize its equipment and services to fulfill specific customer needs. For instance, SK Hynix chose its dry photoresist for EUV technology. The Korean memory manufacturer now collaborates with Lam and its partners to improve the dry photoresist process for DRAM chips. BK Lee, head of R&D process at SK Hynix, stated, “The dry resist technology that we are working on with Lam enables exceptionally precise, low defect, and lower cost patterning.” Once customers like SK Hynix standardize their manufacturing on Lam’s equipment and services, it becomes more challenging and expensive for those customers to switch to a competitor’s product and service suddenly. Therefore, it has a high switching cost moat. As long as Lam stays on the cutting edge of research and development and maintains its customer relationships, it will be challenging for other companies to breach its moat. So, although competition is rising and disruption is possible, the company likely has a long growth runway that may extend for decades.

The company may look overvalued today. However, investors willing to hold the stock for three to five years can still buy it at the current price and participate in the potential upside from a memory chip rebound boosted by AI adoption, possibly sending the WFE market to all-time highs—excellent tailwinds for Lam. Aggressive growth investors should consider buying the stock today. I rate Lam a buy.