Donny DBM/iStock via Getty Images

|

Past performance is not indicative of future results. An investment’s return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data as of the most recent month-end may be obtained by visiting our website. |

Dear Clients and Friends

This quarter, the stock market rally broadened beyond the mega-cap U.S. tech stocks that have been in vogue, but enthusiasm for artificial intelligence (‘AI’) continues to have an outsized impact as their valuations have soared. The tremendous advancement in AI technologies is impressive, and long-term structural tailwinds exist. We believe AI has the power to be truly transformational, and like past innovations, we anticipate a long, winding road. The large premiums placed on a handful of companies suggest investors believe the value of AI technologies may be limited to a select few. Concentration in these perceived winners has the S&P 500 selling at a price-to-earnings ratio (‘PE’) of 26.0x trailing earnings at quarter end.

Chasing this latest trend is expensive, and once a stock market trend gains enough traction to have a catchy name, its golden era may already be over. A recent Wall Street Journal analysis of the eight named trends over the last decade indicated that the named group of stocks saw performance peak 12 months after being given a moniker.[1] As we write, the “Magnificent Seven”[2] is celebrating its 11th month birthday. They represent 18% of the MSCI All Country World Index (ACWI). This dominance has caused the U.S. equity markets to represent a staggering 60% of the MSCI ACWI Index—an influence that we have not seen in more than two decades.

Not surprisingly, this environment reminds us of the late 1990s when the market chased productivity and tech stocks. The sectoral performance patterns, narrow market leadership and high valuations we see today resemble the explosive, pre-bubble rally from late 1998 to early 2000. By contrast to the late 1990s, these market-leading companies are more profitable. At the same time, the overall stock market has a lower assumed volatility, suggesting high confidence. The Chicago Board Options Exchange (CBOE) Market Volatility Index, or VIX, which has become synonymous with market sentiment and an anchor for risk management, is hovering at record lows—almost half the level of the late 1990s. More recently, it has fallen -30% from one year ago and -80% from March 2020. This signals a bull market to some, while serving as a potential warning sign of trouble ahead for others.

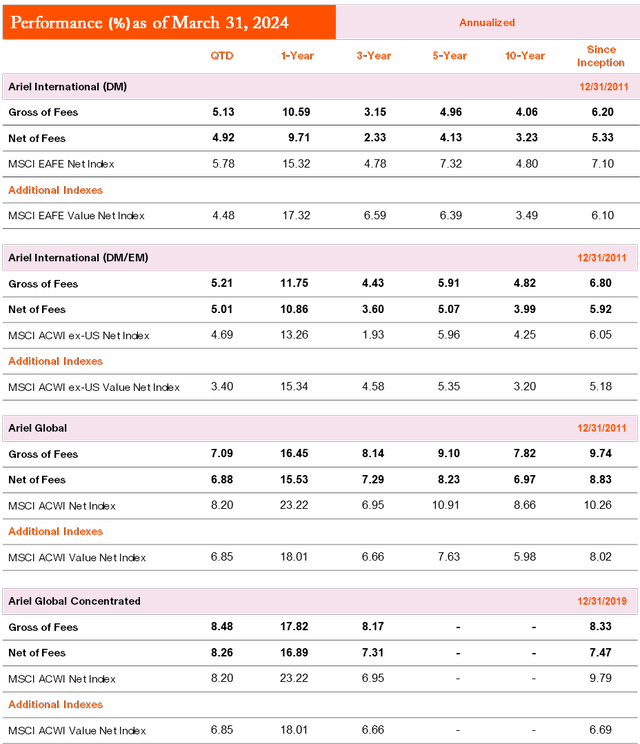

Against this backdrop, the Ariel International (‘DM’) Composite returned +5.13% gross of fees (+4.92% net of fees), shy of the MSCI EAFE Index’s +5.78% rise. Meanwhile, the Ariel International (DM/EM) Composite advanced +5.21% gross of fees (+5.01% net of fees), ahead of the MSCI ACWI-ex US Index’s +4.69% return. In our global portfolios, the Ariel Global Composite returned +7.09% gross of fees (+6.88% net of fees), and the Ariel Global Concentrated Composite advanced +8.48% gross of fees (+8.26% net of fees), versus +8.20% for the MSCI ACWI Index in the first quarter.

Although some strategies fell short of their respective benchmarks in an up market, we are pleased to see our overall portfolios capture more of the market’s rise than in past rallies, by 1) bringing down cash levels; 2) reducing “tail” positions; 3) lessening portfolio concentration in the largest three positions; and 4) further increasing our focus on stocks with both attractive valuations and solid business momentum. We have intentionally sought to capture more upside while minding downside protection. Our recent upside participation was driven by strong performance from some of our largest positions that do not succumb to “trendiness.” Still, we have maintained the strategy’s defensive tilt that is poised to withstand economic deceleration and provide downside protection.

Investor FOMO

A powerful technology shift is underway, driven by AI, and long-term success depends on the ability to scale and generate revenue from new AI-powered products and services. For example, some large-scale AI applications require 100x more processing power than current models which will force companies to make sizeable investments. As winners and losers emerge, we like the prospects for semiconductor companies and cybersecurity. Semiconductors are foundational to the immense computation resources that drive AI’s complex algorithms.

Last quarter, we discussed three semiconductor holdings: Intel Corporation (INTC), Samsung Electronics Company, Ltd. (OTCPK:SSNLF), and Taiwan Semiconductor Manufacturing Co. (TSM) While Intel fell -11.9% for the first three months of the year, the business fundamentals remain compelling for long-term investors. Meanwhile, Samsung was up +0.7%, but is lagging in high-speed memory in these early rounds. It is working hard to catch up and has the potential to tap into this fast-rising segment soon. Lastly, global semiconductor leader Taiwan Semiconductor Manufacturing Co. surged +26.4% during the first quarter.

Also supercharged by FOMO, the Nikkei 225 Index (NKY:IND) representing the biggest Japanese companies, reached an all-time high this quarter after being in a holding pattern for 34 years. Japan’s economic success and stock market rebound are largely attributed to 25 years of reform efforts in Tokyo. While the sharp rise has meant fewer attractively-valued opportunities in Japan, we benefitted from owning automobile and aerospace manufacturer, Subaru Corporation (OTCPK:FUJHY), which soared +25.7% following a solid earnings report and future potential in the electric vehicle category. With Japan amped up by FOMO hype, investors may want to look at South Korea, as Seoul seeks to replicate Tokyo’s success through corporate tax incentives, prioritizing shareholder returns and a new “Korea Value-Up Index”[3] for those with improved governance.

These programs should benefit banks like KB Financial Group (KB), which is one of the largest bank-centric financial groups in Korea. The stock was a strong contributor in our global portfolios this quarter—gaining +25.3% following strong capital returns to shareholders through dividends and buybacks in addition to the company’s robust and stable diversified profit structure.

When it comes to avoiding FOMO, one study suggests “…a shift in attentional control: Focus less on the potential losses of missing out and focus more on immediate gains for what’s being done in the now.”[4] The Chinese stock market looks like the opposite of FOMO these days and may represent future gains that will come from “what’s being done in the now.” We remain bullish on Mainland China stocks trading at low valuations, which stand to benefit from a gradual economic recovery. Although China’s dominant search engine, Baidu, Inc. (BIDU), fell -11.7% during the quarter, we continue to have strong conviction in the name. The company has a stable revenue model from its search ad business as well as growth opportunities based on noncore investments in AI cloud.

Looking Ahead

The overall AI narrative is one of inevitability with many anticipating a productivity tipping point. While broad optimism continues to prevail, there is a cautious undertone. Equities now carry premium valuations with volatility near historical lows during a time when geopolitical and political uncertainties remain high. As many know, hope is not a plan. And so, we are evaluating the potential drivers of economic and market fluctuations and preparing for possible scenarios:

- The AI bloom comes off the rose.

- Wars and worldwide challenges/uncertainties spark a sharp sell-off.

- Economic slowdown with prolonged rising inflation.

The AI and AI-enabled companies in our portfolios have benefitted from booming growth but have not kept pace with valuations. Accordingly, we believe they have room to run. At the same time, our holdings do not carry the same risks as today’s celebrity stocks.

Our attention to risk management and emphasis on companies with proven histories of stable revenues and earnings growth in varying economic environments will become increasingly important during any slowdown. Given our lower risk exposures, our portfolios should be insulated on the downside.

People Update

Vivian Lubrano

(Senior Vice President, Global Equities, Portfolio Manager and Senior Research Analyst, Portfolio Manager: Ariel International (DM), Ariel International (DM/EM), Ariel Global, Ariel International Fund, Ariel Global Fund, Co-Portfolio Manager: Ariel Global Concentrated)

We are delighted to welcome Vivian Lubrano as Senior Vice President, Portfolio Manager, Global Equities and Co-Portfolio Manager, Global Concentrated. In her new role, she will work alongside me and Ariel veteran, Micky Jagirdar supporting the management of our global and international strategies. The new global equities portfolio management structure will emulate the Emerging Markets Value oversight where long-time collaborators and portfolio managers, Vlad Byalik and Christine Phillpotts, CFA®, assist in the management of the EMV portfolios.

Vivian joins us from Alliance Bernstein (AB) where she spent over 15 years in a variety of research and portfolio management-related roles. Most recently, she served as portfolio manager for both the AB Diversity Champions–a thematic, global equities portfolio focused on diversity, equity and inclusion–and AB

Responsible U.S. Equity (ReUSE)–a large-cap U.S. equities portfolio exclusive to Bernstein Private Wealth Management. Prior to this role, Vivian worked as a senior research analyst on AB’s emerging markets value and emerging markets strategic core offerings. She began her career as an investment banking analyst in the global leveraged and corporate finance division at Merrill Lynch & Company. A native of the Dominican Republic, and fluent in Spanish and French, Vivian earned an MBA from the Wharton School of Business at the University of Pennsylvania and a BS in operations research and industrial engineering from Cornell University.

Vivian is an independent thinker and collaborative team player. Her intellectual agility is underscored by extensive fundamental research and industry expertise. Vivian’s bottom-up, in-depth sector coverage across financials, internet, construction and construction materials, consumer cyclicals, consumer staples and industrial companies will serve us well.

Sincerely,

Henry Mallari-D’Auria, Chief Investment Officer, Global and Emerging Markets Equities

|

Investments in non-U.S. securities may underperform and may be more volatile than comparable U.S. stocks because of the risks involving non-U.S. economies, markets, political systems, regulatory standards, currencies, and taxes. The use of currency derivatives, exchange-traded funds (ETFs) and other hedges may increase investment losses and expenses and create more volatility. Investments in emerging markets present additional risks, such as difficulties in selling on a timely basis and at an acceptable price. The intrinsic value of the stocks in which the portfolios invest may never be recognized by the broader market. The portfolios are often concentrated in fewer sectors than their benchmarks, and their performance may suffer if these sectors underperform the overall stock market. Investing in equity stocks is risky and subject to the volatility of the markets. Past performance does not guarantee future results. Performance results are net of transaction costs and reflect the reinvestment of dividends and other earnings. Net performance of each Composite has been reduced by the amount of the highest fee charged to any client in each Composite during the performance period. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. A complete fee schedule is available upon request and may also be found in Ariel Investments LLC’s Form ADV, Part 2. Returns are expressed in U.S. dollars. Current performance may be lower or higher than the performance data quoted. The Ariel International (‘DM’) Composite differs from its benchmark, the MSCI EAFE Index, because: (i) the Composite has fewer holdings than the benchmark, (ii) the Composite will invest in Canada, and (iii) the Composite will at times invest a portion of its assets in the U.S. and emerging markets. The Ariel International (DM/EM) Composite differs from its benchmark, the MSCI ACWI (All Country World Index) ex-US, because: (i) the Composite has fewer holdings than the benchmark and (ii) the Composite will at times invest a portion of its assets in the U.S. The Ariel Global Composite differs from its benchmark, the MSCI ACWI (All Country World Index), because the Composite has fewer holdings than the benchmark. The Ariel Global Concentrated Composite differs from its benchmark, the MSCI ACWI (All Country World Index), because the Composite has dramatically fewer holdings than the benchmark. The opinions expressed are current as of the date of this commentary but are subject to change. The information provided in this commentary does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security. There is no guarantee that any expressed views will come to fruition or any investment will perform as described. As of 3/31/24, the Ariel International (‘DM’) (representative portfolio) position size, if any, in the above holdings was Subaru Corporation 5.90%; Baidu, Inc. ADR 2.15%; Samsung Electronics Company, Ltd 1.84%; KB Financial Group, Inc. 1.82%; Taiwan Semiconductor Manufacturing Co., Ltd. 1.25% and Intel Corporation 0.00%. As of 3/31/24, the Ariel International (DM/EM) (representative portfolio) position size, if any, in the above holdings was Subaru Corporation 5.92%; Baidu, Inc. ADR 3.39%; Samsung Electronics Company, Ltd 3.17%; KB Financial Group, Inc. 2.24%; Taiwan Semiconductor Manufacturing Co., Ltd. 1.37% and Intel Corporation 0.00%. As of 3/31/24, the Ariel Global (representative portfolio) position size, if any, in the above holdings was Baidu, Inc. ADR 3.22%; Subaru Corporation 3.15%; Intel Corporation 2.94%; Samsung Electronics Company, Ltd 2.34%; Taiwan Semiconductor Manufacturing Co., Ltd. 2.21% and KB Financial Group, Inc. 1.92%. As of 3/31/24, the Ariel Global Concentrated (representative portfolio) position size, if any, in the above holdings was Subaru Corporation ADR 5.98%; Baidu, Inc. ADR 3.86%; Samsung Electronics Company, Ltd GDR 3.74%; Taiwan Semiconductor Manufacturing Co., Ltd. ADR 3.67%; Intel Corporation 3.60% and KB Financial Group, Inc. ADR 2.13%. Investors cannot invest directly in an index. The MSCI EAFE Index is an equity index of large and mid-cap representation across 21 Developed Markets (‘EM’) countries around the world, excluding the U.S. and Canada. Its inception date is May 31, 1986. The MSCI EAFE Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the US and Canada. Its inception date is December 8, 1997. The MSCI ACWI (All Country World Index) ex-US Index is an index of large and mid-cap representation across 22 Developed Markets (‘EM’) and 24 Emerging Markets (‘EM’) countries. Its inception date is January 1, 2001. The MSCI ACWI ex-US Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 22 Developed and 24 Emerging Markets countries. Its inception date is December 8, 1997. The MSCI ACWI captures large and mid cap representation across 23 Developed Markets (‘DM’) and 24 Emerging Markets (‘EM’) countries. The inception date is May 31, 1990. The MSCI ACWI Growth Index captures large and mid cap securities exhibiting overall growth style characteristics across 23 Developed Markets (‘DM’) countries and 25 Emerging Markets (‘EM’) countries. Its inception date is December 8, 1997. The MSCI ACWI Value Index captures large and mid cap securities exhibiting overall value style characteristics across 23 Developed Markets countries* and 24 Emerging Markets (‘EM’) countries. Its inception date is December 8, 1997. All MSCI Index net returns reflect the reinvestment of income and other earnings, including the dividends net of the maximum withholding tax applicable to non-resident institutional investors that do not benefit from double taxation treaties. MSCI uses the maximum tax rate applicable to institutional investors, as determined by the companies country of incorporation. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI. Footnotes 1Horstmeyer, Derek., “Once a Hot Stock-Market Trend Has a Name, Its Best Days Are Likely Past,” The Wall Street Journal, published March 1, 2024 and accessed April 1, 2024. 2Magnificent Seven – Nvidia Corporation, Meta Platforms, Inc., Amazon, Inc., Microsoft Corporation, Alphabet Inc., Apple Inc. and Tesla, Inc. 3The Korea Value-Up Index is a new benchmark index currently being developed by the KRX. The newly developed index will be composed of companies that have outstanding valuations and those demonstrating improvement in their valuations. Companies with outstanding performance in their valuation enhancement efforts may be eligible to receive preferential treatment in being included in the value-up index. The KRX is currently examining various issues regarding the development of the valueup index. In close consultation with institutional investors, the KRX plans to finish up developing Korea value-up index by the third quarter of this year.” Source: Financial Services Commission Press Release, March 14, 2024. 4Hobson, Nick, Ph.D., “The Science of FOMO and What We’re Really Missing Out On,” Psychology Today, published April 23, 2018 and accessed April 1, 2024. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.