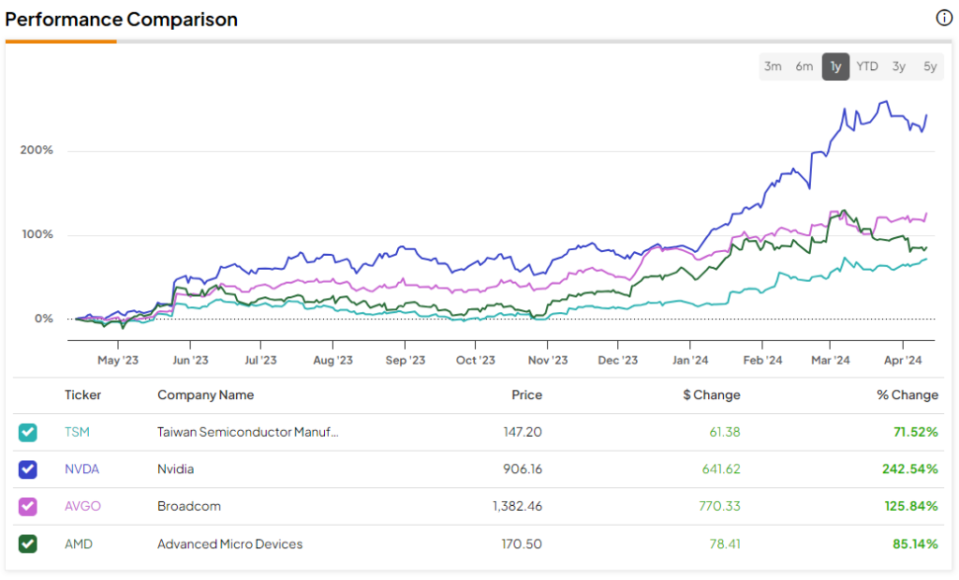

Taiwan Semiconductor Manufacturing (NYSE:TSM), the world’s largest chipmaker, recently posted impressive revenue figures for March. Notably, Nvidia (NASDAQ:NVDA), which has gained 242.5% in the past year, relies on TSM for chip manufacturing. However, TSM’s stock performance (up 71.5% over the same period; see the comparison image below) has been relatively subdued. This begs the question: can TSM replicate NVDA’s stellar performance? The answer is likely a “yes.”

With the ongoing AI boom, increased funding from the U.S., and an attractive valuation, TSM looks like a compelling buy right now.

Pre-Earnings Numbers Point to Positive Outlook for Upcoming Earnings

On April 10, TSM unveiled impressive revenue figures for March, marking the highest month-over-month growth since November 2022 at 34.3% year-over-year, totaling 195.2 billion New Taiwan dollars (approximately $6.1 billion). Additionally, Q1 revenues are projected to increase by 16.5% year-over-year, reaching 592.6 billion New Taiwan dollars (around $18.4 billion).

It’s worth noting that TSM anticipates mid-20% revenue growth for FY 2024, fueled by strong demand for its latest nano chips amid the AI surge. Moreover, the company reaffirmed in January 2024 that its AI revenues are growing rapidly at approximately 50% annually. This reaffirmation is particularly reassuring following the revenue decline reported in 2023.

TSM manufactures the chips and supplies them to tech titans like Nvidia, Advanced Micro Devices (NASDAQ:AMD), and Apple (NASDAQ:AAPL). Ahead of its Q1 earnings release expected on April 18, let’s take a look at what the future holds for TSM.

AI Revolution Will Spur Growth at TSM

The AI revolution has taken the world by storm. I firmly believe that its growth trajectory is enduring. The AI industry, still in its infancy, is projected to witness remarkable expansion across diverse industries and applications. According to Next Move Strategy Consulting, the industry is anticipated to burgeon into a $1.85 trillion behemoth by 2030, compared to around $208 billion in 2023.

TSM’s customers heavily rely on the company for the production of chips they design. An uproar in demand for everything AI has led to a huge demand for AI chips.

To add to the AI growth spurt, TSM got yet another boost to its manufacturing operations, as it received approval for direct federal funding worth $11.6 billion under the U.S. government’s CHIPS Act. The company will receive $6.6 billion in grants to expand its manufacturing facility in Phoenix, Arizona. In addition, TSM is eligible for an incremental loan of $5 billion.

TSM has already invested in building two plants at the site and will use the funding to build an additional factory. The firm’s total investment across all three factories is estimated at $65 billion. This marks the “largest foreign direct investments in a greenfield project in U.S. history,” according to the press release.

TSM plans to produce 2-nanometer technology chips at the second factory starting in 2028. In the coming years, TSM should reap the benefits of massive investments that will greatly enhance its manufacturing operations and bring in the latest technological advancements.

Sharing his optimism, TSM Chairman Mark Liu stated, “Our U.S. operations allow us to better support our U.S. customers, which include several of the world’s leading technology companies. Our U.S. operations will also expand our capability to trailblaze future advancements in semiconductor technology.”

To date, the majority of TSM’s manufacturing capabilities are based in Taiwan, which poses a geographical risk (potential threat of Chinese invasion, earthquakes, etc.). With the latest expansion announcement, that risk will be alleviated. With increased manufacturing in the U.S., TSM will likely more efficiently cater to its top-notch clients like Nvidia, AMD, and Apple based in the U.S. On top of that, record-high crypto prices are creating higher demand for chips, adding to TSM’s growth outlook.

TSM Is Trading at a Cheap Valuation

In terms of its valuation, TSM looks cheap. Currently, it’s trading at an attractive forward P/E ratio of 23x compared to much higher multiples of its peer group. Semiconductor company Advanced Micro Devices is trading at a higher forward P/E multiple (49x), while the AI prodigy Nvidia is trading at a forward P/E of 36.4x.

Wall Street analysts expect TSM’s EPS to reach $9.02 in FY 2026. If TSM keeps the same forward P/E multiple by then, its share price will be about $207, 45% higher than the current price. Therefore, it makes sense to consider buying TSM stock at current levels, given the strong growth potential in the AI space.

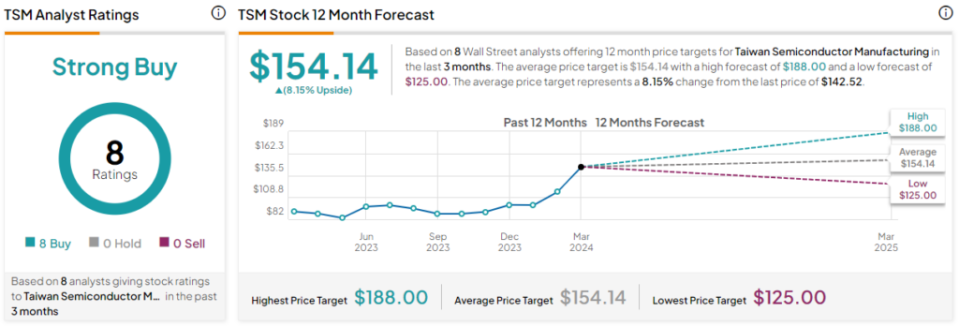

Is TSM Stock a Buy, According to Analysts?

The Wall Street community is clearly optimistic about Taiwan Semiconductor Manufacturing stock. Overall, the stock commands a Strong Buy consensus rating based on eight unanimous Buys. TSM stock’s average price target of $154.14 implies 8.2% upside potential from current levels.

Conclusion: TSM Presents a Strong Opportunity for Long-Term Growth

The semiconductor industry is experiencing a significant surge, largely driven by the AI boom. TSM, along with its AI-focused counterparts, stands to gain from this relentless demand. With strategic investments and expansion plans in place to meet future demands, TSM appears well-positioned for sustained growth. Considering these factors, I am inclined to buy the stock at its current levels, anticipating long-term benefits from its AI potential.