China has set up its third planned state-backed investment fund to boost its semiconductor industry, with a registered capital of 344 billion yuan (US$47.5 billion), a filing with a government-run companies’ registry showed.

Chinese chip shares rose, with the CES CN Semiconductor Index rallying more than 3 percent and set to log the biggest one-day gain in more than a month.

The third phase of the fund, also known as the “Big Fund,” was officially established on Friday and registered under the Beijing Municipal Administration for Market Regulation, National Enterprise Credit Information Publicity System, a government-run credit information agency, data showed.

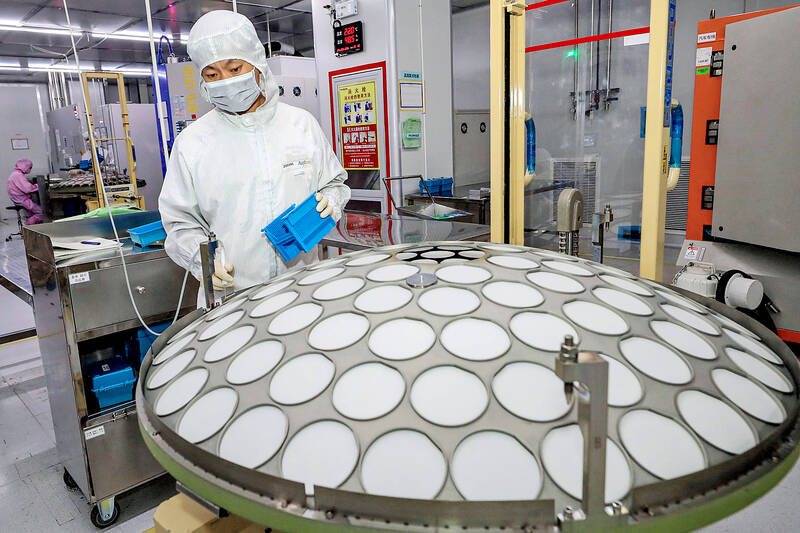

Photo: AFP

It was also the largest of the three funds launched by the China Integrated Circuit Industry Investment Fund.

Its biggest shareholder is the Chinese Ministry of Finance, with a 17 percent stake and paid-in capital of 60 billion yuan, followed by China Development Bank Capital, with a 10.5 percent stake, said Tianyancha (天眼查), a Chinese companies’ information database company.

Seventeen other entities are listed as investors, including five major Chinese banks: Industrial and Commercial Bank of China (中國工商銀行), China Construction Bank (中國建設銀行), Agricultural Bank of China (中國農業銀行), Bank of China (中國銀行) and Bank of Communications (交通銀行), with each contributing about 6 percent of the total capital.

The first phase of the fund was established in 2014, with registered capital of 138.7 billion yuan, and the second phase was in 2019, with 204 billion yuan.

The Big Fund has provided financing to China’s two biggest chip foundries, Semiconductor Manufacturing International Corp (中芯國際) and Hua Hong Semiconductor Ltd (華虹半導體), as well as to Yangtze Memory Technologies Co (長江儲存), a maker of flash memory, and a number of smaller companies and funds.

One of the major areas the third phase of the fund would focus on is equipment for chip manufacturing, Reuters reported in September last year.

The Big Fund is also considering hiring at least two institutions to invest the capital from the third phase.

Comments will be moderated. Keep comments relevant to the article. Remarks containing abusive and obscene language, personal attacks of any kind or promotion will be removed and the user banned. Final decision will be at the discretion of the Taipei Times.