The relentless demand for faster, smaller and more efficient electronic devices is finally pushing existing silicon technology to its physical limits. Decades of phenomenal innovation have largely delivered the prophesy of Moore’s Law, which predicts that the number of transistors that can be crammed onto a silicon chip should double every two years, but there are growing signs that it is becoming too difficult to maintain that pace of progress. Chipmakers like Intel and TSMC are introducing radically new device architectures to continue the trend towards increased feature sets on smaller geometries, while a technology roadmap produced by imec, the microelectronics research center in Leuven, Belgium, suggests that new electronic materials will start to displace silicon in mass-market devices from the mid-2030s as they emerge from research and become commercialized.

The rise of wide-bandgap semiconductors

In practice, however, the transition to these emerging electronic materials is likely to be more gradual. Other semiconductors already offer a competitive advantage for specific applications and would offer significant benefits for mainstream digital electronics if manufacturing costs could be reduced. Notable among them are semiconductors with a wider bandgap than silicon, such as gallium nitride and silicon carbide. This wider bandgap yields devices with faster switching speeds, which enables more compact designs using smaller passive components, as well as lower losses for greater efficiency. Wide-bandgap devices are also more resilient to high voltages and high temperatures, making them an ideal fit for the power electronics market.

| Characteristic vs Technology | Silicon | SiC | GaN |

|---|---|---|---|

| Thermal conductivity (Watts/cm2K) | 1.5 | 1.3 | 5.0 |

| Critical breakdown voltage (106 V/cm) | 0.3 | 3.0 | 3.5 |

| Bandgap (eV) | 1.1 | 3.2 | 3.4 |

| Electron mobility (cm2/kV-sec) | 10.0 | 22.0 | 25.0 |

| Electron saturation velocity (106 cm/sec) | 10.0 | 22.0 | 25.0 |

Wide bandgap materials are already finding many applications in radio frequency amplifiers and power conversion applications. In general, the higher the figure for each characteristic, the better the performance of the device. Source: Avnet

Indeed, silicon carbide has already carved out a significant commercial niche in applications where the voltage and temperature requirements are particularly high, such as power inverters, industrial motors and fast chargers for electric vehicles.

Meanwhile, gallium nitride grown on silicon wafers offers a cost-effective technology that can make use of existing manufacturing infrastructure. Radio-frequency devices based on gallium nitride are already widely used in mobile base stations, while the high-power density that can be achieved makes them a good bet for fast charging devices for consumer electronics, as well as for high-speed applications in data centers and self-driving cars. Underlining that potential was Infineon’s acquisition of Canadian company GaN Systems in 2023, while market analysts Yole Intelligence predicts that sales of power devices based on gallium nitride will grow from $250m in 2023 to $2.5bn in 2029.

Meanwhile, in the EV power conversion market, IDTechEx expects combined sales of GaN and SiC to significantly outstrip those of silicon by 2035. Of course, other materials may emerge from research in the meantime to impact these figures during the next decade.

Diamond, the ultimate power semiconductor

While these two materials start to chip away at silicon’s dominance, diamond promises to deliver a next-generation solution for power electronics – particularly as more of our energy supply switches to renewable sources of electricity. With its ultrawide bandgap, diamond has an extremely high breakdown voltage, a thermal conductivity that is far superior to any other semiconductor material, and a high carrier mobility for both electrons and holes. Early diamond devices have been demonstrated, while significant investment in the sector is now starting to overcome the manufacturing obstacles that have so far hindered commercialization.

One has been the challenge of growing large diamond wafers, which until recently were limited to diameters of just a few millimeters. But start-up companies such as Diamfab in France and Adamas One Corp. in the US have now demonstrated single-crystal wafers at diameters of up to 100 mm, with a focus now on reducing the density of defects. The other key challenge lies in doping such a dense material to control its electronic properties, with the electron-conducting n-channel proving especially challenging. Recent research is now starting to address that issue, with US start-up Advent Diamond offering diamond epilayers with n-type and p-type doping and researchers in Japan demonstrating the first n-channel diamond transistor in early 2024

Even in the long term, the benefits of diamond are likely to shine brightest in heavy-duty power applications. And while the other wide-bandgap semiconductors are set to take more market share, imec’s technology roadmap suggests that the long-term replacement for silicon is likely to be a material that can be fabricated in layers just one atom thick. Such 2D materials burst on the scene with the discovery of graphene in 2004, with its planar geometry shown to deliver high electrical and thermal conductivities along with excellent mechanical properties.

Graphene does not have an intrinsic bandgap, however, which means that it cannot provide the switching functionality needed for digital electronics – with the result that most graphene devices are being developed for sensing or analog applications. A breakthrough came in 2024, when researchers in the US and China devised a way to fabricate semiconducting graphene on a silicon carbide substrate. This material has a useful bandgap of 0.6 eV and an electronic mobility 10 times greater than that of silicon, plus it can be doped and nanopatterned to further enhance its performance. While not yet widely integrated into useful devices, the demonstration opens the door to more high-speed graphene transistors for digital applications. Graphene has already been used by UK firm, Paragraf, in the manufacture of field effect transistors, and to make Hall effect sensors capable of measuring a range of magnetic field strengths from µT to over 7 T at ultra-low, cryogenic temperatures.

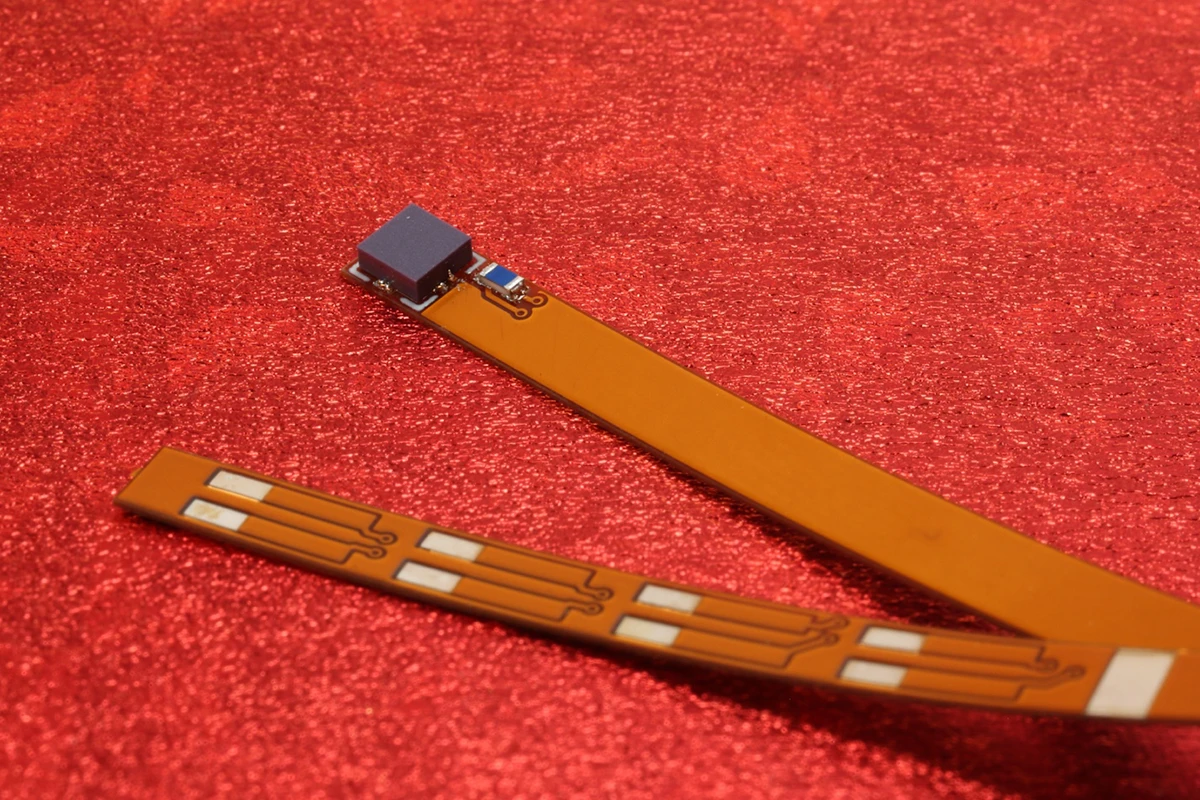

- An ultra-low temperature, wide range Hall sensor based on graphene that can measure with less than 10 millikelvin precision (Image: Paragraf)

The next frontier of 2D materials

Meanwhile, researchers have been investigating a myriad of other 2D materials that already possess semiconducting properties. Many of them belong to the family of transitional metal dichalcogenides (TMDs), layered materials in which metal atoms are sandwiched between a chalcogen such as sulfur and selenium. Molybdenum disulfide (MoS2) has emerged as a promising candidate, offering high stability, a bandgap nearly twice that of silicon, and the potential to be used in flexible electronics. However, its carrier mobility remains notoriously slow, a drawback that researchers are now attempting to address through various processing strategies such as defect engineering, doping, and the application of strain. Indeed, researchers at the University of Stanford have shown that the electron mobility within an MoS2 transistor can be doubled by applying a strain of just 0.7%.

At the same time, researchers have been searching for other potential candidates. A study by scientists at the University of Texas at Austin identified more than a dozen new 2D semiconductors that could offer mobility at least one order of magnitude higher than existing TMDs, although none have yet been fabricated or tested. Meanwhile, a more recent analysis singles out a known TMD, tungsten disulfide, as the most promising 2D semiconductor, with the potential to reach ultrahigh carrier mobilities if fabrication challenges such as low defect densities and low-resistance contacts can be achieved.

Among these more exotic materials, carbon nanotubes (CNTs) stand out as a more mature technology option. The electrical properties of CNTs can be tuned by altering their geometrical configuration, while recent improvements in material quality and processing have enabled practical transistors to be fabricated from layers of aligned carbon nanotubes. Researchers at MIT were the first to demonstrate a microprocessor that combines CNT transistors with proven CMOS technology, while in 2024 a Chinese team used 3000 CNT transistors to create a specialized processor for applications in artificial intelligence. The same team also showed that CNT-based transistors delivering superior performance can be fabricated with the same feature sizes as silicon devices produced in the 2007–8 timeframe, and they believe that their design could be scaled down further to achieve feature sizes less than 10 nm.

With so many emerging contenders being investigated by the research community, it’s hard to know which one might ultimately challenge the dominance of silicon. What seems unlikely, however, is that the future electronics industry will replace silicon with an equivalent one-size-fits-all material. Instead, the increasingly demanding requirements of diverse applications will drive the development of multiple electronic materials providing the optimal performance for each one. And silicon itself will continue to be an important material for semiconductor devices.

Alex Iuorio

Alex Iuorio, SVP Supplier Development, Avnet, is a 30-year veteran of the high-tech distribution industry. He has held various positions across the globe at Avnet across the globe

Related Avnet articles: