Artificial intelligence (AI) has captivated investors across the board. From large institutional financial services firms to smaller retail investors, AI is playing a big role in how money is moving nowadays.

What’s a little surprising, however, is that capital appears to be primarily concentrated in a small basket of mega-cap technology stocks. The “Magnificent Seven” is a term used to collectively describe the world’s largest tech companies — and unsurprisingly, all of them are disrupting AI in some form.

Perhaps the most intriguing member of the Magnificent Seven is semiconductor leader Nvidia. While the company appears to have an edge over its peers, investors should understand that the chip realm has many different components.

In other words, not all semiconductor businesses are developing products that compete with Nvidia. In fact, many chip companies are working alongside Nvidia and are benefiting as a result of the company’s growth.

One chip stock that I think is quietly hovering under the radar right now is Micron Technology (NASDAQ: MU). Let’s dig into Micron’s business and assess why now looks like a lucrative opportunity for long-term investors to scoop up some shares.

How does Micron benefit from Nvidia?

Nvidia develops a series of sophisticated computer chips called graphics processing units (GPUs). These play a big role in generative AI applications such as machine learning, training large language models (LLMs), and quantum computing.

While Nvidia faces competition from AMD and Intel, the company is estimated to have at least 80% of the AI-powered chip market. Nvidia has built its lead over the competition thanks to demand for its H100 and A100 products. The company has also already developed its next-generation line of GPUs, known as Blackwell and Rubin.

Micron specializes in memory storage products that are integrated into chips. Micron isn’t competing with Nvidia. Rather, the company actually works with Nvidia and is benefiting from the demand fueling chips right now.

Sold out through next year

One of Micron’s core products is called the High Bandwidth Memory (HBM) 3E, which is layered on Nvidia’s GPUs. The company began shipping its HBM3E products during this past spring. While it’s still a new product for Micron, the initial traction from HBM3E gives investors a lot to be excited about.

For its fiscal 2024’s third quarter (ended May 30), Micron generated $6.8 billion in revenue — up 84% year over year. HBM contributed $100 million during the quarter as shipments began to ramp. Management stated: “We expect to generate several hundred million dollars of revenue from HBM in fiscal 2024 and multiple billions of dollars in revenue from HBM in fiscal 2025.”

Furthermore, management really shocked investors when they noted that “HBM is sold out for calendar 2024 and 2025, with pricing already contracted for the overwhelming majority of our 2025 supply.”

Is now a good time to buy Micron stock?

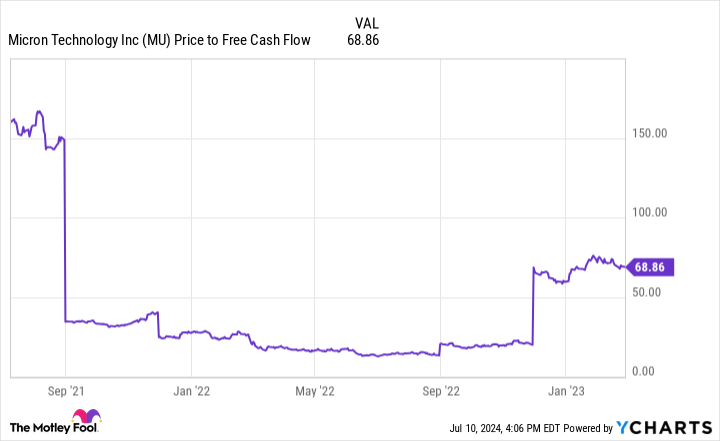

The chart below illustrates the price-to-free cash flow (P/FCF) multiple for Micron over the last three years. Although a P/FCF of 68.9 is pricey, the multiple is notably lower than in some prior periods.

Admittedly, the valuation analysis above could be misleading. Part of the reason why Micron’s P/FCF is normalizing is because, like many technology businesses, the company is experiencing abnormal demand right now. As a result, revenue and margins are accelerating.

However, the blemish with Micron revolves around profitability. The company inconsistently reports positive operating income, free cash flow, and net income. This means that during some quarters, the company actually posts a net loss.

Since the semiconductor space is highly cyclical, Micron’s ebbs and flows regarding profits aren’t entirely surprising. However, I’m optimistic that the success of the HBM solutions can help Micron attain some degree of pricing power as it looks to fulfill supply and demand. In theory, this should help smooth out the company’s cash flow and profitability.

For those reasons, I think Micron is well-positioned to continue benefiting from the AI boom and the specific demand trends surrounding chip businesses. Moreover, given that its latest innovation is already sold out through next year, I think it’s obvious that the company’s products are well-received.

While shares of Micron aren’t necessarily dirt cheap, I see the stock as a compelling buy for long-term investors looking for alternatives to Nvidia.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $791,929!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 8, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia: 1 Other Unstoppable Semiconductor Stock to Buy Instead was originally published by The Motley Fool