Indie Semiconductor: Artificial Intelligence Processing Is A Game Changer (NASDAQ:INDI)

Editor’s note: Seeking Alpha is proud to welcome London Stock Market Research as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Jonathan Kitchen

Investment Thesis

I am bullish on indie Semiconductor, Inc. (NASDAQ:INDI) because I expect successful collaboration with Expedera, together with efficiency improvements and efforts at improving scalability and enhancing power consumption. In addition, I assumed further Adjusted EBITDA growth from collaborations with Top Tier 1 automotive suppliers, further improvement of the backlog of $6.3 billion, and inorganic growth. I valued the company between $8 and $9 per share. I obtained these values by using discounted cash flow analysis, a comparison with previous transactions, and acquisitions made by Indie.

Indie Semiconductors – Overview

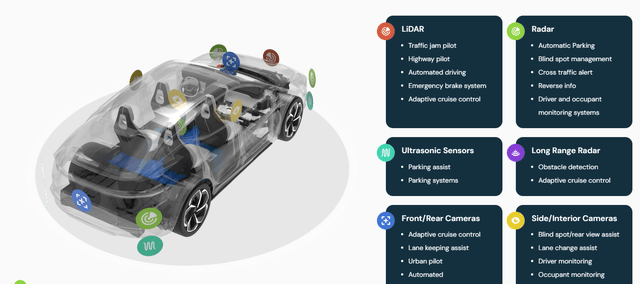

Indie Semiconductors offers automotive semiconductors and software solutions focused on applications like ADAS, in-vehicle entertainment, parking assist, cameras for vehicle detection, and other innovative tools.

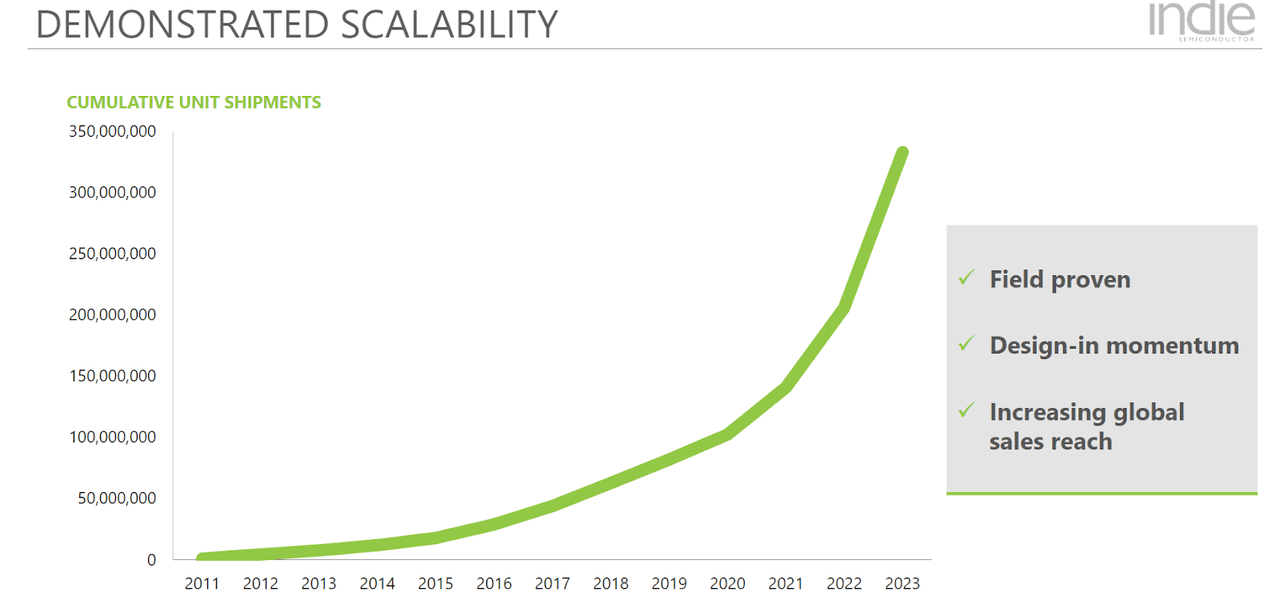

Indie began as a project between engineers with a long career in the industry in 2007, becoming the first manufacturers of CMOS signal amplification systems for mobile devices, inserting 250 million of their products into the market, prior to entering the list of public companies in 2015. Most investors out there may know the company for its technology for in-cabin experience and electrification efforts.

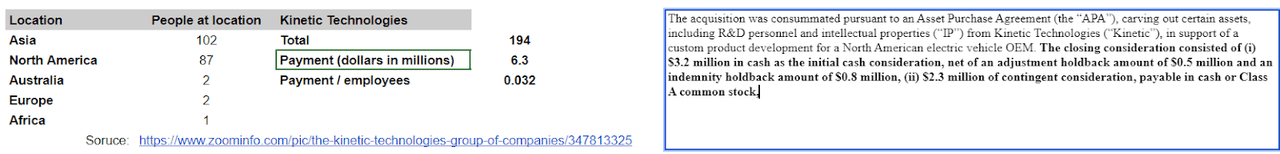

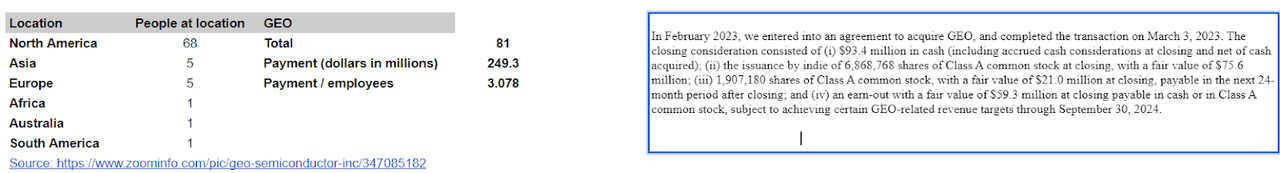

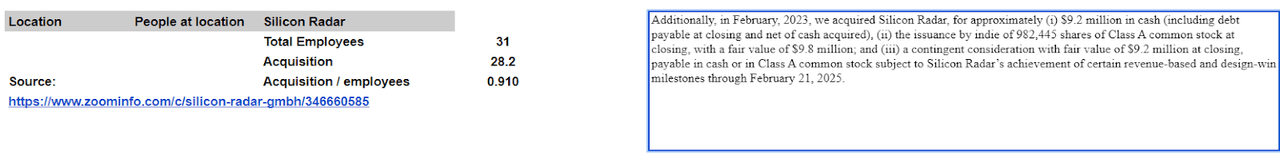

Indie is not only appealing because it operates in a growing market, inorganic growth also appears to be one of Indie’s specialties. The company has carried out a series of acquisitions, including Symbeo GmbH during 2022 and GEO Semiconductor. Likewise, Indie maintained its growth strategy through acquisitions during 2023 and 2024, including Silicon Radar and Exalos AG. The most recent acquisition is that of Kinetic Technologies, carried out during January 2024, which included the entire business, along with the personnel and intellectual property of the company.

The company reports a significant number of individuals with expertise in the acquisition of targets. Ms. Parekh, who sits in the Board of Directors, brings expertise acquired in large investment banks. With this person and others in the Board of Directors, I would expect more inorganic growth.

Ms. Parekh has more than 25 years of global capital markets and operational experience in the high growth Technology, Media, Telecommunications and Consumer Internet industries, both as an advisor and senior executive. Prior to working at HPE, Ms. Parekh held several senior leadership roles at global investment banks, including Barclays Capital, Goldman Sachs and Jefferies. There she advised private and public companies on a variety of transactions including M&A, capital structuring, joint ventures, private placement, as well as on business development and strategic growth initiatives at the board level. Source: Board Of Directors

With revenue growth, management recently announced that a richer product mix and new product pipeline could expand the gross margin and narrow operating losses. With this comment in my mind, I decided to execute some due diligence about the stock and its current valuation.

At the same time, we are planning on gross margin expansion to the 51 to 52 percent range from a richer product mix, flat expenses and, in turn, a narrower operating loss on a sequential basis. Source: Quarterly Press Release

Based on the strength of our new product pipeline, we plan to return to high growth mode in the back half of this year and to resume our industry-leading growth trajectory into 2025 and beyond. Source: Quarterly Press Release

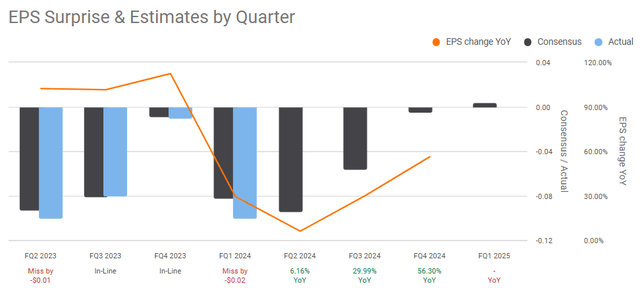

R&D Expenses Could Lead To Positive 2025 Net Income

I recently appreciated quite a bit that Indie continues to report increases in the R&D expenses. We are talking about double-digit R&D expenses growth reported in the last quarter. In my experience, companies investing in R&D usually report headcount growth and net sales growth. I see these efforts paying off for the company in 2025. In my DCF model, I assumed that 2025 unlevered FCF could be positive. Q1 2025 EPS estimates from Seeking Alpha are also positive.

In the last report, Indie Semiconductor noted that it is trying to expand its product development activities, which is like music for my ears.

The increase of $13.0 million or 36% was primarily due to a $3.7 million increase in personnel costs to support our continuous growth in research and development needs and a $10.7 million increase in share-based compensation expense. Source: 10-Q

We expect research and development expense to continue to increase as we continue to grow our headcount organically to support expanded product development activities. Source: 10-Q

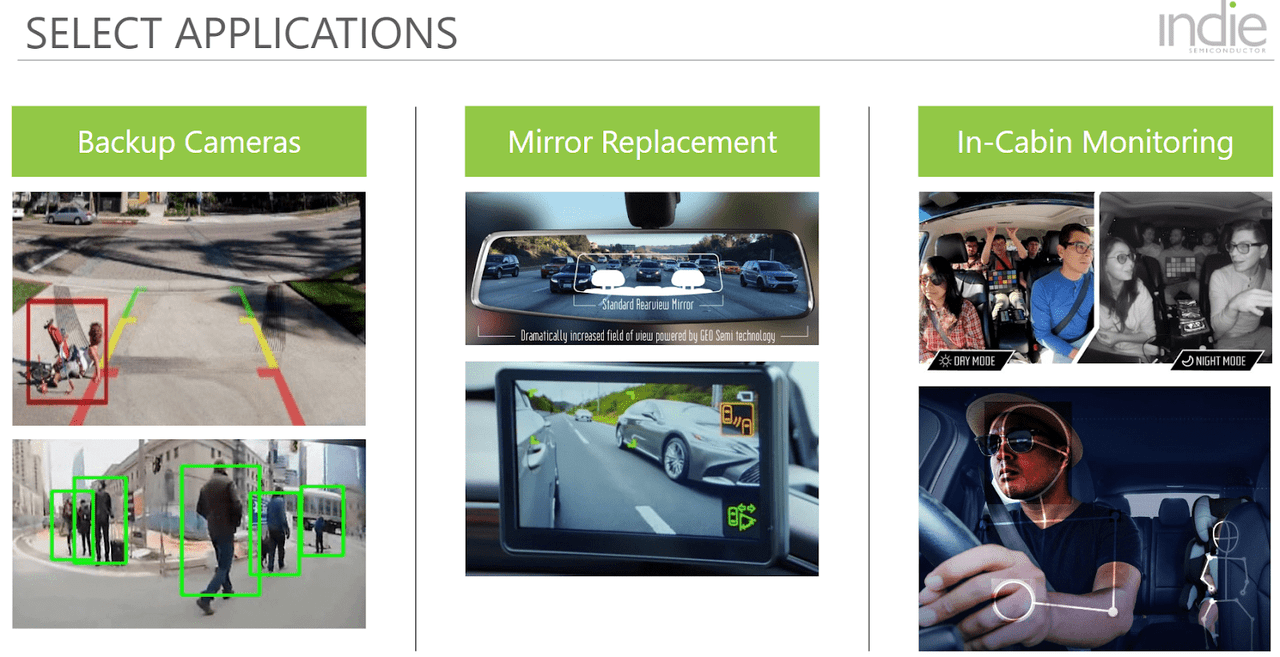

I cannot really go through all the innovations recently announced. However, in the last presentation to investors, management noted improvements in in-cabin monitoring, backup cameras, and mirror replacements.

With regard to other new innovations, in May 2024, the company announced a new investment in Expedera. The new agreement could bring scalable Neural Processing Unit semiconductor intellectual property, which could bring a new generation of more efficient AI processors.

Through this partnership, indie will leverage Expedera’s NPU IP to develop innovative next-generation ADAS solutions with embedded artificial intelligence processing capabilities. Source: Indiesemi

The new investments in R&D could bring new services like image signal processing, and digital signal processing. With these new tools, in my opinion, the company may increase the price of their systems, or offer optional innovations. Besides, new tools may bring new product demand from more clients.

William N. Leonard published several papers noting that R&D spending relates to growth rates of sales. The author notes that the relation appears two years after R&D spending. Hence, I expect that the new investment in Expedera could bring net sales growth in 2026 or 2027.

Research intensity, measured by company R&D spending, relates significantly to growth rates of sales, assets, net income, and other variables of sixteen industries performing nearly all manufacturing activity. The relation appears two years after R&D spending and increases thereafter. Research intensity, measured by manpower ratios, relates less effectively. When research intensity ratios include federal R&D funds, correlations with growth rates fall, usually below significance. Source: Research and Development in Industrial Growth

It is also worth noting that ADAS applications offered could become more scalable, so that the NPU processes and reacts to a lot of information including traffic lights, sign recognition, or the actions of pedestrians.

Besides, I think that enhancing power consumption could also be quite beneficial for the company’s top line of the income statement. In general, anything that contributes to expanding the EV’s battery life will be welcomed by market participants.

My valuation process incorporates assumptions with respect to the collaboration with Expedera, increases in R&D expenses, and successful product development. I also assumed that improvements in power consumption and scalability will be some of the revenue growth and Adjusted EBITDA growth catalysts.

Target Market Growing At 13% CAGR Will Have A Beneficial Effect On Net Sales Growth

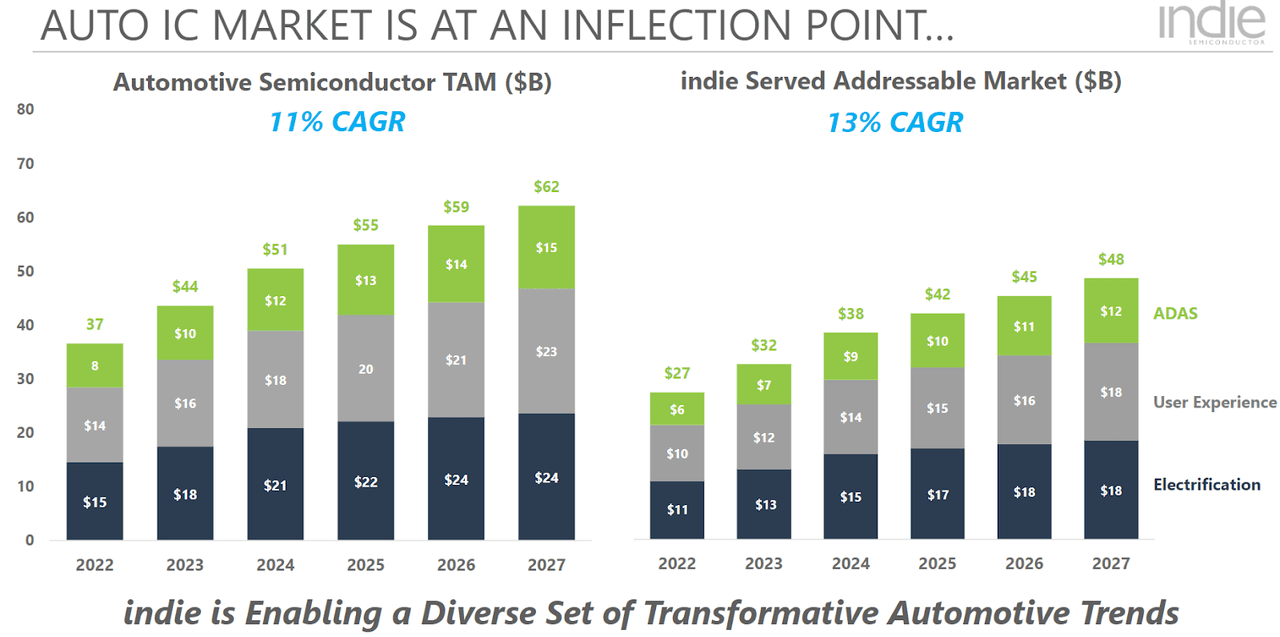

The company is expected to benefit from the growth in the automotive semiconductor market, which is growing at close to 11%. Allied Market Research, for instance, reports that the global automotive semiconductor market size could grow at a CAGR of 10.1% from 2023 to 2032.

Indie also made an estimate about its served addressable market, which could grow at close to 13% from 2022 to 2027. I think that Indie’s net sales growth may not be far from the growth in these target markets.

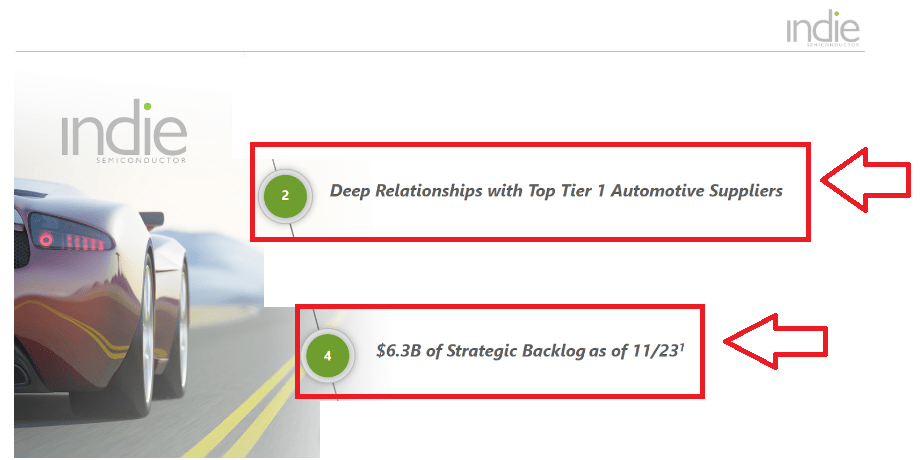

INDI Outperforms Its Peers Thanks To Good Relationships With Top Tier 1 Automotive Suppliers

I would also expect significant net sales growth thanks to the company’s relationships with Top Tier 1 automotive suppliers. In my view, these relationships could explain why Indie seems to out-execute and outperform its industry peer group in 2024. In addition, the strategic backlog, which was valued at close to $6.3 billion in 2023, gives valuable insight about future net sales growth.

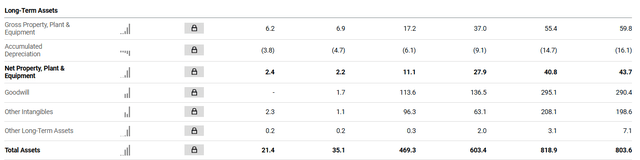

Source: Presentation

Company’s Financials And Balance Sheet: Goodwill Growth, And R&D

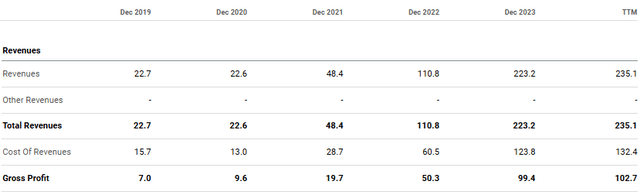

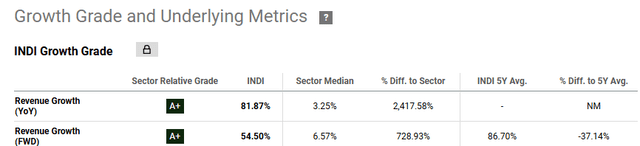

INDI’s total revenue TTM is close to $235 million. In 2023, the company reported revenue of $223 million. Revenue growth is quite impressive. In 2019, revenue was close to $22 million.

According to the tool offered by Seeking Alpha, revenue growth YoY is 81%, and forward revenue growth is 54%. Revenue growth is significantly higher than that reported by other companies in the same sector. I studied these financial figures to design my discounted cash flow analysis.

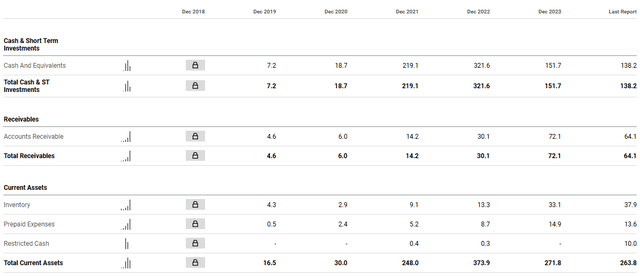

The balance sheet shows a large increase in the total amount of cash, from $7 million in 2019, to $138 million in the last report. Total current assets also increased from $16 million in 2019 to $263 million in 2024. In my view, investors are giving cash to INDI, which explains the recent increase in liquidity. In my view, investors pump in more cash because they expect that INDI’s net income could become positive from 2025. As soon as market participants see the first positive EPS, I think that the demand for the stock could increase. 2025 EPS estimate is equal to $0.12.

The total amount of assets increased from $21 million in 2019 to more than $803 million in 2024. Goodwill also increased significantly as a result of recent acquisitions. In the last report, goodwill was close to $290 million. It is worth noting the recent acquisition of Kinetic Technologies, LLC, which could increase motor control electrical efficiency in the coming years. Given previous acquisitions, and successful integration I would expect more inorganic growth in the future. I think that INDI knows how to buy other competitors.

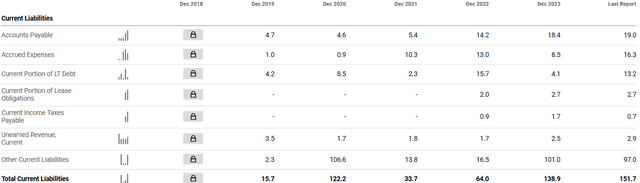

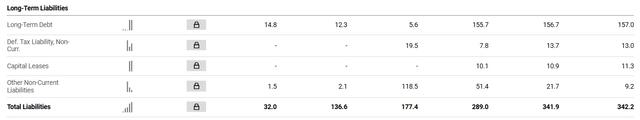

In the last report, total current liabilities is equal to $151 million, and total liabilities is $342 million. The ratio asset/liability is 2.3x, so I think that that company’s financial situation is stable. Long-term debt is equal to $157 million. In my view, management could receive more debt financing in the future. If 2025 net income becomes positive bankers may offer better financing conditions to INDI.

Source: Seeking Alpha Source: Seeking Alpha

Valuation Using Previous Acquisitions Made By Indie Semiconductor

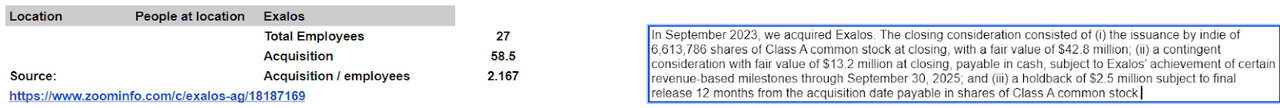

I reviewed the acquisitions made by Indie Semiconductor. I studied the number of employees that those companies had and the payment made. The list of targets includes Kinetic, GEO, Silicon Radar, and Exalos. The information was obtained from the last annual report, and I used the database provided by Zoominfo. The following is information about the results that I obtained.

Source: Zoominfo Source: Zoominfo Source: Zoominfo Source: Zoominfo

The median acquisition/employees ratio is $1.5 million per employee. According to Zoominfo, Indie Semiconductor reports around 900 employees. Hence, the implied valuation would be $8.23 per share. The share count I used is equal to 168 million.

The number of shares outstanding of the registrant’s Class A and Class V common stock as of May 7, 2024 was 168,168,203 (excluding 1,725,000 Class A shares held in escrow and 26,064 Class A shares subject to restricted stock awards) and 18,594,328, respectively. Source: 10-Q

Source: My Own Calculations

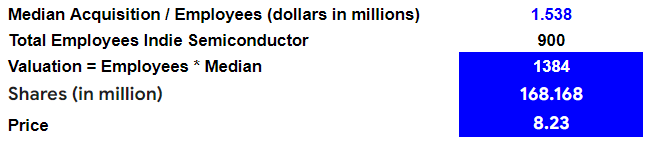

I also compiled a number of acquisitions executed from 2013 to 2021 in the industry. Using the ratio of acquisition contribution/revenue, I obtained a median ratio of 3.5x. I used 2025 net sales of $408 million, which is an assumption I made based on expectations offered by Indie and my own judgment. SA’s estimates are close to mine. Multiplying 2025 net sales*Median I obtained a total valuation of $1.43 billion. Dividing by the share count, I obtained an implied fair price of $8.5 per share.

Source: Author’s Calculations

Valuation – Discounted Cash Flow Analysis

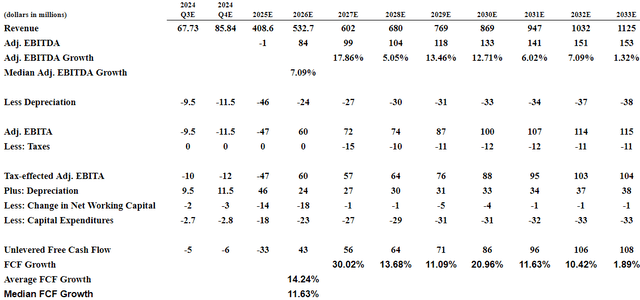

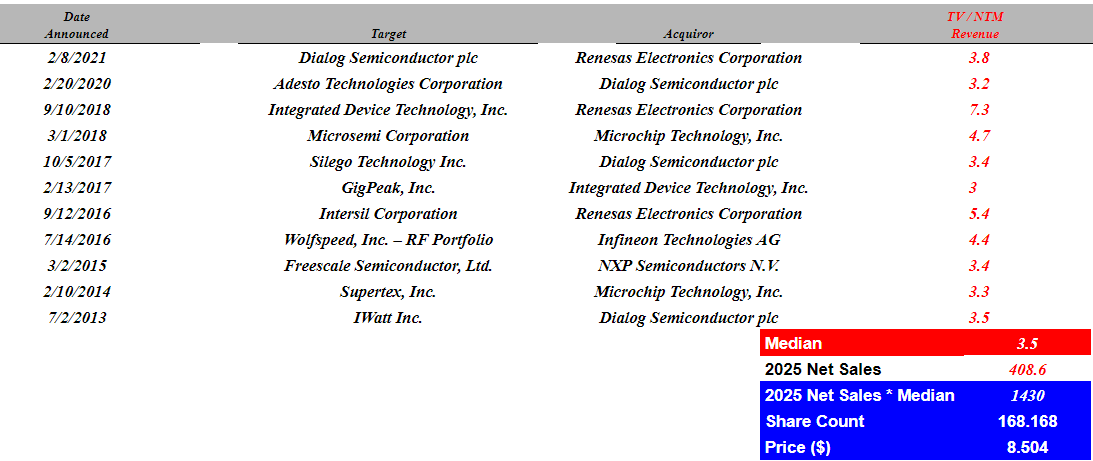

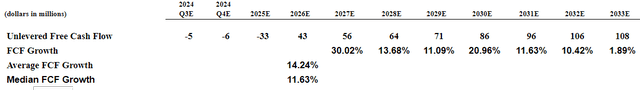

I performed a discounted cash flow analysis of Indie Semiconductor to calculate the estimated present value of the standalone unlevered, after-tax free cash flows that Indie forecasted. I calculated terminal values for the company by applying perpetuity growth rates of 4%. My numbers are based on my professional judgment and experience.

My assumptions about Adjusted EBITDA growth, D&A, taxes, capital expenditures, and changes in working capital are connected to both numbers delivered by INDI. I also assumed that good relationships with top Tier 1 automotive suppliers, the growth in the automotive semiconductor market, and the agreement with Expedera could bring business growth.

The company reported 101% YoY growth in 2023 thanks to Tier 1, and OEM validation, and improving product mix. In 2022, revenue growth was close to 129% YoY, and in 2021 total revenue growth was 114%.

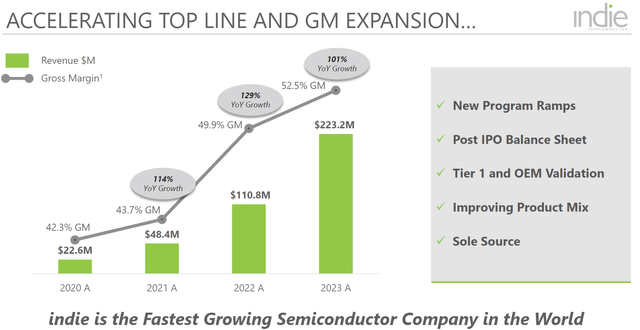

I think that revenue growth will be lower than 101% YoY from 2025 to 2033. According to experts, the global automotive semiconductor market size could grow at a CAGR of 10.1% from 2023 to 2032. Besides, Indie noted in a recent presentation that its served addressable market could grow at close to 13% from 2022 to 2027. So, I assumed 13% sales growth from 2026 to 2031, and 9% sales growth in 2032, and 2033.

Under these conditions, I foresee net sales growth from 2025 to 2033 as well as D&A growth, and capex increase. Median Adjusted EBITDA growth from 2027 to 2033 would be close to 7%. In addition, the median unlevered FCF growth from 2026 to 2033 would be 11%, and the median Adjusted EBITDA growth would be 11%. The Adjusted EBITDA Margin and the unlevered FCF margin are also in line with that of competitors.

Source: Author’s Calculations Source: Author’s Calculations

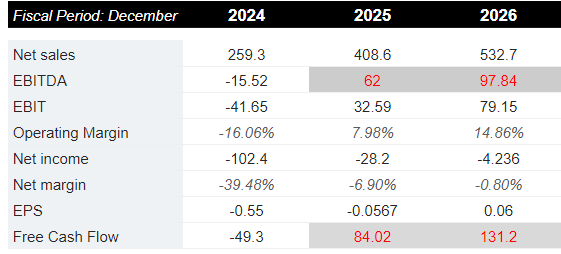

My numbers are a bit lower than the expectations from other analysts. I assumed 2025 EBITDA of -$1 million, and 2025 unlevered FCF of -$33 million.

With information from S&P Global Market Intelligence, a total of 8 analysts delivered expectations that include positive EBITDA in 2025 close to $62 million, and 2026 EBITDA of $97 million. They are expecting positive EBITDA in 2025, and 2026. I do not think that they could revise the most recent reported EBITDA for the last quarter, which was the lowest it has ever been. I tried to be a bit more conservative than those analysts.

Source: S&P Global Market Intelligence

The cash flows and terminal values were discounted using a discount rate of 8%, based on an estimate of Indie Semiconductor’s weighted average cost of capital. I calculated the implied equity of Indie Semiconductor by subtracting the net debt from the implied enterprise value. Dividing the result by 168 million shares, I obtained the implied per share equity value of $8-$9 per share.

There Are Many Competitors Out There, And The Industry Consolidates

The semiconductor industry is characterized by high technological innovation and rapid transformations in relation to the usefulness of products and prices in the market. In fact, prices for the main products have decreased in recent years as a general trend. This feature and the declines in demand are factors that directly affect the development of the business.

The competitive capacity within the market is conditioned on the one hand by the availability of resources for the development and research, and on the other hand by adaptation to customer demands.

Furthermore, at present, the market trend is moving towards the consolidation of the main participants, which would translate into lower acquisition and declining circulation of the products of small companies.

If we use Indie’s annual reports, the main competitors currently for this company are Infineon, Monolithic Power Systems, NXP, Renesas, and ST Microelectronics. These are leading companies with international reach that have superior resources for the research and distribution of their products.

Taking a look at the markets in general, we must also add Mobileye, LeddarTech, Helm, Uhnder, Phantom, RealTime Robotics, Silicon Mobility, and AutoBrains within the list of competitors for Indie, taking into account all product lines and not only the specialized line of the historical core of the company.

Risks From Third-Party Manufacturers

Indie depends on outsourced manufacturers to complete its production phases, and the manufacturing processes in this sense are highly delicate, in which any impurity in the procedure can lead to the obsolescence of the product, with the addition that they are difficult to identify in their early phases. The company has already suffered delays and negative conditions from complications in manufacturing and the performance of its suppliers.

Furthermore, the transformation of its products due to the needs of its customers leads in some cases to the readjustment of manufacturing conditions, and in these changes, there is a risk that the performance margins decrease significantly. In this segment, we must also consider the availability of raw materials and the inability to replace one of the essential ones due to the low supply in the market, which, although it is not a direct risk arising from its manufacturers, is one of the factors which can complicate this process in terms of meeting deadlines and performance margins.

Risks From Client Concentration

Although the concentration of sales in Aptiv, its main client, has decreased significantly from 2021 to 2023, in my view, this situation continues to represent a risk factor for Indie. If Aptiv decides to stop working with the company total net sales will fall sharply.

Along with this, Indie’s main outlet market for its products is direct suppliers to the automotive industry, which means that its sale is conditioned by the conditions of this market, and any disruption may be transferred to the company’s activity.

At this point, we must consider that at the beginning of the decade, there were a large number of forecasts about the adoption of electric vehicles globally in the short term. Although their use and demand has grown, the forecasts have not been met in the expected measure, which has delayed the growth of the semiconductor sector for automotive manufacturing, which is of great need in electric and self-driving cars.

Reverse Recapitalization Risks

The company executed a reverse recapitalization in order to become public. Some investors may not appreciate that Indie did not organize an IPO, in which more due diligence is executed about the financial accounts. In my view, Indie may receive less demand for the stock because of this fact.

On June 10, 2021, we completed a series of transactions with Thunder Bridge Acquisition II, Ltd pursuant to the Master Transactions Agreement dated December 14, 2020, as amended on May 3, 2021 The Transaction was accounted for as a reverse recapitalization in accordance with generally accepted accounting principles in the United States of America. indie is deemed to be the accounting predecessor of the combined business and is the successor registrant for U.S. Securities and Exchange Commission purposes, meaning that our financial statements for previous periods will be disclosed in the registrant’s future periodic reports filed with the SEC. Source: 10-k

Takeaway

My investment thesis includes successful collaboration with Expedera, efficiency improvements, scalability growth, and lower power consumption. Adding further collaboration with Top Tier 1 automotive suppliers and the current backlog of $6.3 billion, I valued the company between $8, and $9 per share. I obtained these values by using discounted cash flow analysis, a comparison with previous transactions, and acquisitions made by Indie. I do not think that the company could sell itself at a lower level than $8 per share. In any case, I think that Indie is a good company to hold for a long period of time. Indie looks like a winner in the industry.