PM Images

While indie Semiconductor, Inc. (NASDAQ:INDI) has gotten a boost off the lows from takeover speculation, the stock is still far below the SPAC price from years ago. The automotive semiconductor has a massive opportunity ahead for the cheap stock price and for the company to cash out now. My investment thesis remains ultra-Bullish on the stock with the opportunity ahead.

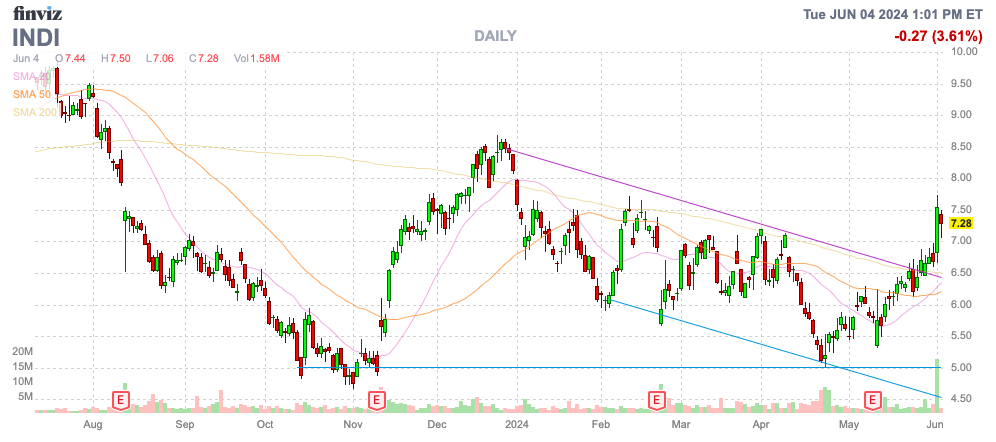

Source: Finviz

Market Headwinds

indie Semi. reported a weak quarter at the start of May. The automotive market is facing some short-term headwinds as auto production slows, and the market shifts to more legacy models and away from EVs with higher semi. content.

The company did report sales grew 29% YoY to $52 million, but indie Semi. guided to sequential sales flat and up to 5% growth to reach $55 million in the June quarter. Last Q2, the company reported sales of $52 million, suggesting YoY growth could be flat now.

indie Semi. didn’t update investors on the backlog, but the company last provided an estimate of $6.3 billion at the end of last year. The company currently has a market cap of only $1.4 billion and is running sales at just a $260 million clip despite having a backlog of at least 4x the market cap.

The market will ultimately shift towards ADAS functionality and more advanced technology, mostly focused on EVs. The U.S. market shifting away from EVs in the short term has hampered some of the technology content spend in current vehicle sales, but the long-term opportunity hasn’t changed.

On the Q1 ’24 earnings call, CEO Don McClymont highlighted this situation as follows:

This forecast reflects weaker demand stemming from persistently higher interest rates and inflationary pressures and in turn has led to consumers opting for more economical de-featured car models, which typically carry lower semiconductor content. In particular, the EV market has been exhibiting precipitous decline in consumer demand of late.

Odd Buyout Speculation

Investors are no doubt frustrated indie Semi. closed the SPAC deal back in 2021 at $10 and the stock recently traded below $7. The company has grown quarterly sales from $10 million when going public via the SPAC to hitting $70 million for Q4’23.

indie Semi. is supposedly working with an adviser to explore strategic options, including soliciting potential bidders. The company just cashing out for a small premium would make absolutely no sense with the massive backlog.

The current market situation highlights the market dynamic where a legacy vehicle generates $700 in silicon content and the market is headed towards as much as 10x the content per vehicle. Market dynamics have more consumers stuck on the lower-end content vehicles, but this won’t last over time.

Source: indie Semi. presentation

indie Semi. ended the quarter with a cash balance of nearly $150 million. Management could be looking for a transaction providing access to more cash to feed additional corporate flexibility and growth.

The forecast is for indie Semi. to become EBITDA profitable by Q4. The company isn’t in any dire financial situation to warrant a rushed or dilutive financial transaction.

The company has 52% gross margins with a goal of reaching the 60% threshold over time. As the business scales, operating expenses will dip to 30% of revenues, providing for 30% operating margins.

For now, though, non-GAAP operating expenses are in the $40 million quarterly range. Until revenues rebound back above the Q4 levels, indie Semi. will continue producing large losses, including Q2 forecasts in line with Q1 EBITDA loss of $16 million.

In the Q1 ’24 earnings release, indie Semi. predicted a return to fast growth in the 2H ’24 as follows:

Based on the strength of our new product pipeline and a general market recovery as channel inventory levels normalize, we plan to return to high growth mode in the back half of this year and to resume our industry-leading growth trajectory into 2025 and beyond.

The numbers and forecasts aren’t very supportive of indie Semi. trying to cash out at the lows of the last few years. The automotive tech sector should see a massive growth phase throughout the rest of the decade, allowing the company to participate in significant growth.

indie Semiconductor, Inc. stock trades at only slightly above 3x 2024 sales targets, with strong growth backed up by the large backlog.

Takeaway

The key investor takeaway is that indie Semiconductor, Inc. has no reason to sell the stock with the massive growth opportunity ahead. The market rumors of a potential sale are likely misplaced.

Investors should continue using any weakness to load up on the cheap auto tech play.