Nvidia’s planned China-specific chip signals a shift in semiconductor competition dynamics

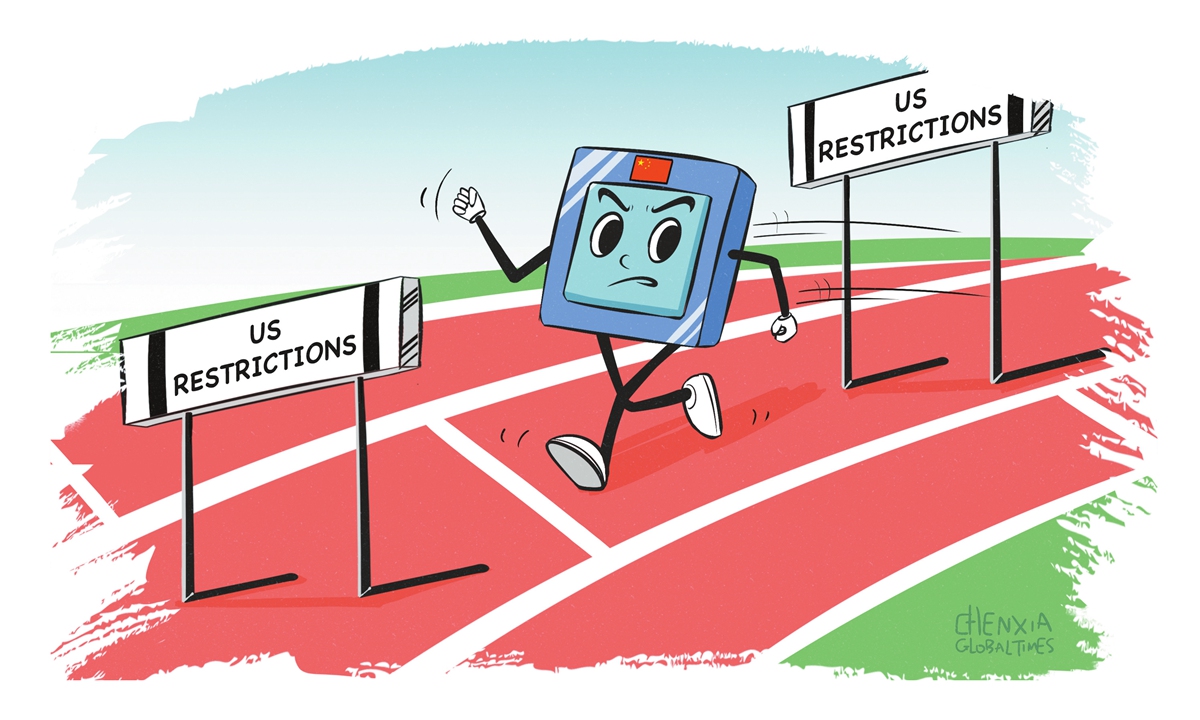

Illustration: Chen Xia/GT

Nvidia appears ready to unveil yet another chip explicitly designed for the Chinese market. According to multiple media reports, the company plans to launch a specific chip for China based on its latest Blackwell architecture as early as June, priced at roughly half that of its previous H20 model. This marks the third time the company has dramatically adjusted its product strategy to comply with US export controls, indicating the shifting dynamics in the China-US semiconductor competition.

Since 2022, when the US government implemented new regulations restricting Nvidia from exporting its most powerful chips to China, culminating three years later in Nvidia’s repeated releases of increasingly downgraded compliant products, the offensive-defensive relationship in US-China technological competition has evolved beyond simple containment and catch-up into a complex, dynamic struggle.

The US initially wielded sanctions as a weapon, leveraging its dominance in advanced manufacturing processes, memory technology and electronic design automation (EDA) tools to sever China’s semiconductor advancement pathway and maintain a technological gap with Chinese chip industries.

The early waves of export restrictions proved effective. They cut off chip supplies to Huawei and forced Chinese artificial intelligence (AI) companies to restructure their computing infrastructure. Some AI startups were compelled to pivot due to their inability to access high-end chips.

Nvidia held near-monopoly control over China’s AI market with its globally dominant CUDA ecosystem and GPU computing technology.

However, the competitive dynamics quickly shifted. Despite enormous supply chain pressures, China implemented support policies for the semiconductor industry while substantially increasing funding to promote domestic alternatives across the entire industry chain.

China rapidly carved out its technological pathways, from imported equipment and memory chips to server manufacturing, open-source AI frameworks, and specialized integration.

Most tellingly, the US Commerce Department’s chip export restrictions have grown increasingly stringent, with policy details becoming ever more precise to the decimal point. This represents reactive technological pursuit and gap-filling, reflecting China’s accelerating industrial upgrade pace.

Nvidia’s operating space has severely contracted. Chips once hailed as “king” have been repeatedly downgraded in bandwidth and computing thresholds, reduced to compromise solutions that barely meet US red lines. More awkwardly, these downgraded chips cannot provide users with genuine high-performance computing experiences while competing directly with advancing domestic alternatives like China’s Ascend 910B chips. Nvidia has gradually become a casualty of the US containment policy toward China.

Nvidia’s Jensen Huang claims that China is a $50 billion opportunity for Nvidia, yet US restrictions have held them back to the point where Nvidia’s CEO has revealed that they could be replaced, since market share has dropped to 50 percent.

The core of China-US competition has reached a critical inflection point. Initially, the US leveraged technological advantages to systematically constrain China’s upgrade trajectory, while China endured pressure and weathered impacts. Through synchronized advancement in policy, capital, and technology, China has broken through the targeted blockade ceiling, actively seeking innovative breakthroughs.

The US continues attempting to suppress China’s achievement of scale advantages through higher-frequency, more detailed measures – new rounds of TSMC foundry restrictions, advanced memory export approvals, and EDA tool patches – all aimed at preserving remaining time advantages.

This incremental strategy will likely persist in the short term, as it is increasingly difficult for the US to maintain its technological priority time lag; and, most importantly, the rules have changed.