While we wait for the Russell 2000 (IWM) to push past the March swing high, we have a Semiconductor Index (SOX) ready to break past a small ‘bull’ flag, using the 200-day MA to leverage the push higher. Technically, the CCI is a ‘sell’ but other indicators are bullish, including a relative performance advantage over the Nasdaq 100.

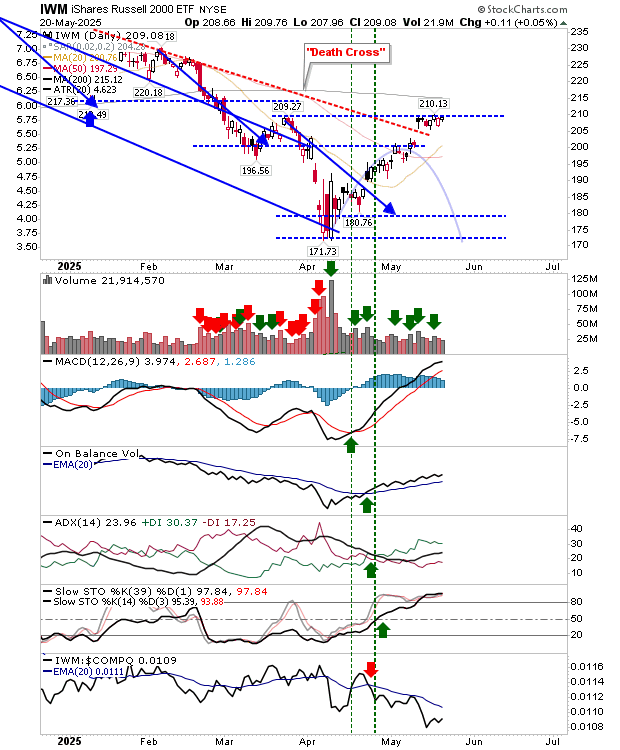

The Russell 2000 (IWM) remains primed to move higher. Little more need be said although an undercut of yesterday’s low would be an aggressive short.

The S&P and Nasdaq remain on course to test February highs off the back of solid technicals.

Bitcoin is pressuring highs – ready to deliver a measured move to $145K if it can close the week near current levels.

(Click on image to enlarge)

For tomorrow, look for trades in the Russell 2000 and Semiconductor Index, and longer term investment opportunities in Bitcoin.

More By This Author:

Nasdaq Surge Exceeds Tariff Sell Off

Rallies Continue Without The April Retest

S&P And Nasdaq Break Through 50-Day MA