Silicon Carbide Luster Is Gone For Axcelis And Other Semiconductor Supply Chain Vendors

John D. Buffington/DigitalVision via Getty Images

There has been a significant shift in the market dynamics for silicon carbide, a critical material in various high-performance electronic and industrial applications. This shift indicates that the once-booming demand for SiC, driven by its superior properties and wide-ranging applications, from electric vehicles (EVs) and renewable energy systems to power electronics, is experiencing a downturn.

I first brought it to reader’s attention with a December 24, 2023 article to my Investing Group entitled “Tracking A 2024 Slowdown In Silicon Carbide For EVs With Eyes On ON And WOLF.”

Several factors have contributed to the decline in SiC demand, each intertwining with broader industry and economic trends:

- Market Saturation: In sectors that heavily rely on SiC, such as the EV market, rapid initial growth may lead to periods of saturation where demand stabilizes or temporarily declines as markets adjust to new supply levels and consumer demand patterns.

- EV Market Saturation or Slowdown: Since SiC components are crucial for electric vehicles, particularly in power electronics and inverters, any slowdown in the EV market directly impacts SiC demand. This has occurred primarily in the U.S. as a temporary plateau in EV adoption rates, but also in some European countries that are reducing subsidies.

However, the inherent advantages of SiC, including its efficiency, durability, and performance in high-temperature, high-voltage applications, continue to make it a material of choice for future technological advancements, possibly heralding a resurgence in its demand.

Strong Impact of Silicon Carbide Downturn on Axcelis Technologies

Axcelis Technologies (NASDAQ:ACLS), a supplier of enabling ion implantation solutions for the semiconductor industry. In March 2021, the first Purion H200 SiC implant model was introduced. It is the first and only single wafer high current implanter designed to cover all high dose implant applications from energies as low as 5keV to a maximum of 200keV, and is especially suited to foundry and power device manufacturers’ needs.

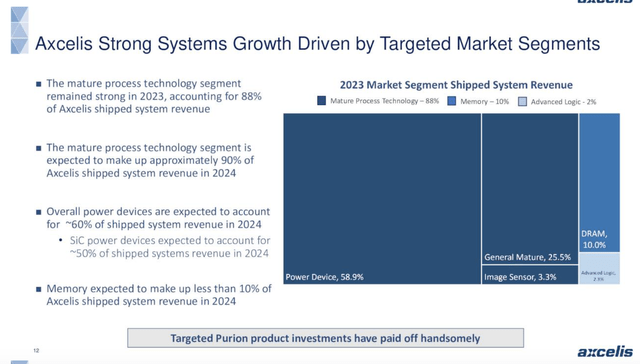

Chart 1 shows that Axcelis expects its Power Device (SiC chips) segment to account for 50% of shipped system revenue in 2024, which is down from the “greater than 55%” of 2023 revenue initially forecast by the company but in actuality ended up at 34% of 2023 revenue. In prospective, SiC made up 39% of revenue in 2021.

Axcelis

Chart 1

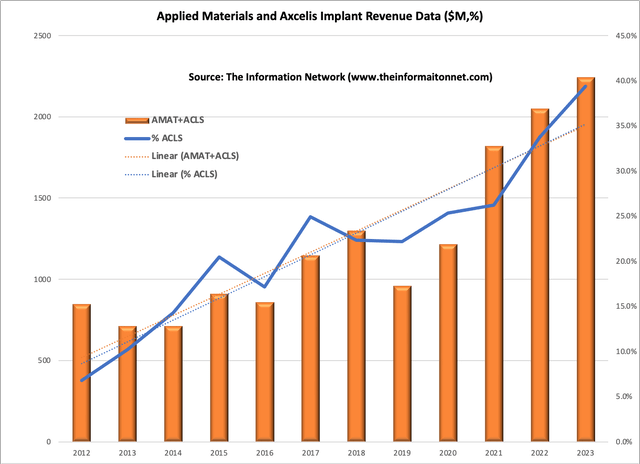

According to The Information Network’s report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts, Chart 2 shows that the Axcelis’ share of the implant market (the combined revenue of ACLS and Applied Materials (AMAT) increased from just 6.8% in 2012 following the acquisition to 39.4% in 2023, up from 33.8% in 2022, and up from 26.2% in 2021.

The Information Network

Chart 2

Trendlines show that while the combined revenue of ACLS and AMAT grew over this period (orange dotted line), the trendline (blue dotted line) showing ACLS’s share increased at a greater rate than the growth of the implant sector.

In addition to implant, Axcelis offers high-temperature annealing systems that are used in the post-implantation annealing of SiC wafers. Annealing is a thermal process that helps activate the implanted dopants and repair any lattice damage caused during ion implantation. Axcelis’ annealing systems provide precise temperature control to optimize the electrical characteristics of SiC devices.

Axcelis also provides plasma cleaning systems that are used for surface cleaning and preparation of SiC wafers. Plasma cleaning removes contaminants and residues from the wafer surface, ensuring high-quality interfaces for subsequent process steps.

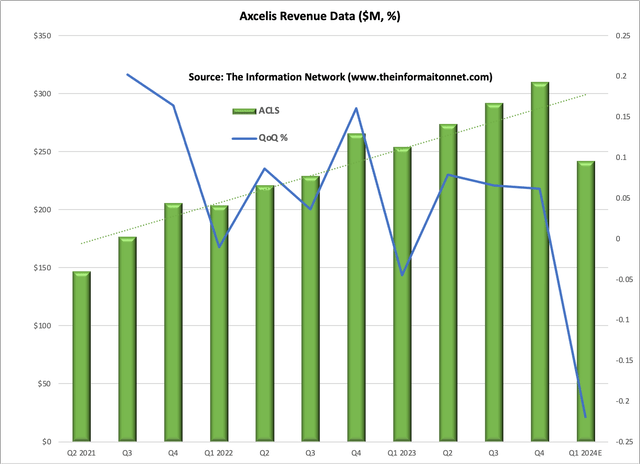

Chart 3 shows revenue by quarter between Q2 2021 and Q1 2024 (estimated from guidance). The Company reported fourth quarter revenue of $310.3 million, compared to $292.3 million for the third quarter of 2023. For the first quarter ending March 31, 2024, Axcelis expects revenues of approximately $242 million.

The Information Network

Chart 3

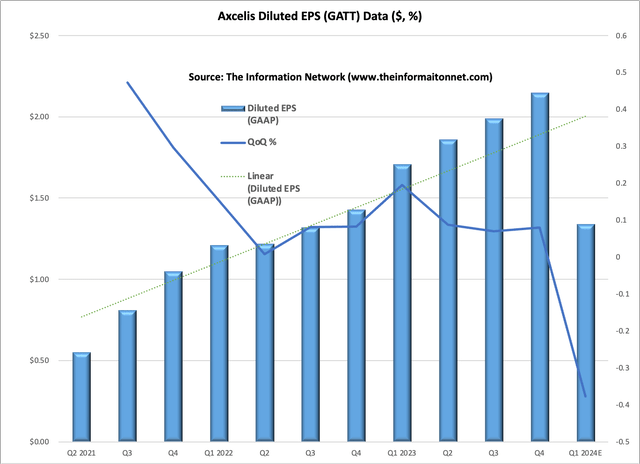

Chart 4 shows diluted EPS (GATT) by quarter between Q2 2021 and Q1 2024 (estimated from guidance). Net income for the quarter was $71.1 million, or $2.15 per diluted share, compared to $65.9 million, or $1.99 per diluted share in the third quarter. First quarter operating profit is forecast to be approximately $45 million with earnings per diluted share of around $1.22.

The Information Network

Chart 4

Silicon Carbide Impacting Other Semiconductor Vendors

inTEST (INTT)

inTEST Corporation supplies test and process solutions for use in manufacturing and testing in automotive, defense/aerospace, industrial, life sciences, security, and semiconductor markets worldwide. In the semi area, the company makes induction heating products used in process applications where precision-controlled heating is needed. The induction heating system technology is available from the acquisition of Ambrell Corporation in 2017.

In other words, while inTEST is moving on sales for SiC, it supplies components to crystal growing companies, such as those manufactured by GT Advanced Technologies.

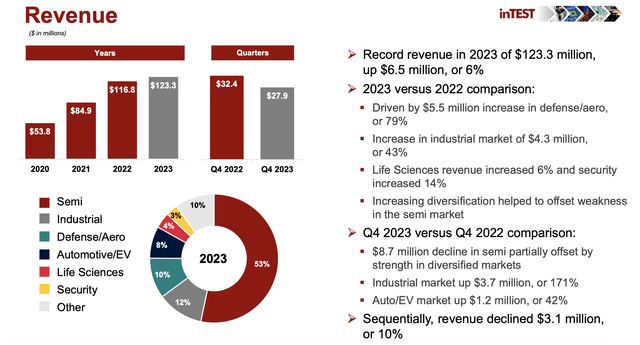

The $8.7 million decrease in revenue from the semi market primarily reflects weakening demand for its induction heating technology solutions for silicon carbide crystal growth applications. Q4 2023 revenue, shown in Chart 5, decreased 10% year over year to $27.9 million. Semiconductor revenue for Q4 2023 versus Q4 2022 dropped $8.7. For the year, semiconductor revenue decreased to 53% of total revenue from 59% in 2022.

For the prior Q3 2023 quarter, semiconductor revenue was up 3% to $19.8 million. This increase was driven by front-end induction heating solutions for silicon carbide crystal growth and wafer epitaxy applications. There was no mention of silicon carbide in Q4 2023.

InTest

Chart 5

Aehr Test (AEHR)

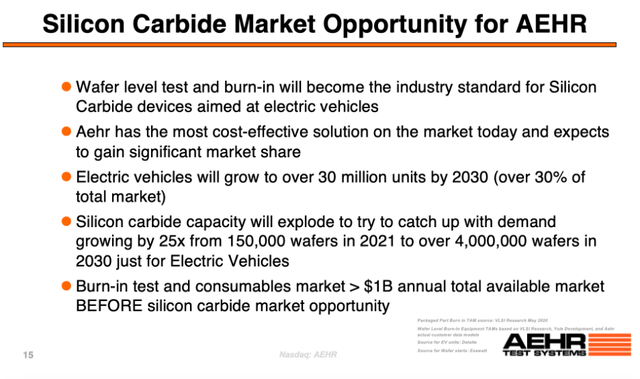

Aehr Test Systems is a worldwide supplier of semiconductor test and production burn-in equipment. Aehr’s FOX-XP test and burn-in system allows for one of the key reliability screening tests to be completed on an entire wafer full of devices, testing all of them at one time, while also testing and monitoring every device for failures during the burn-in process to provide critical information on those devices.

Aehr Test Systems also offers WaferPak™ contactors, which are high-performance test contactors specifically designed for testing SiC devices at the wafer level. These contactors provide efficient electrical connections to the devices on the wafer, enabling precise and accurate testing.

Gayn Erickson, President and CEO of Aehr Test Systems, commented:

“In the last sixty days, we have seen how the slowing of the growth rate of the electric vehicle market has had a negative impact on the timing of several current and new customer orders and capacity increases for silicon carbide devices used in them.

Given the latest forecasts from our customers and the uncertainty on the timing of their orders, we believe it makes sense to take a more conservative approach to our fiscal year forecast and have reduced our growth estimates for fiscal 2024 revenue. We are reducing our revenue expectations of at least $100 million this fiscal year by 15% to 25% to a range of $75 million to $85 million dollars. This is still a growth rate of 15% to 30% year over year.”

Chart 6 shows the silicon carbide market opportunity for AEHR. I’ve discussed the growth of SiC in numerous Seeking Alpha articles. But a key focus for the growth of SiC for AEHR is the need for testing and burn-in.

As a result, burn-in allows removal of bad die prior to packaging in the module with other die, and allows key parameters such as threshold voltage and on resistance to be stabilized of good die prior to packaging in the module with other die.

Aehr

Chart 6

Investor Takeaway

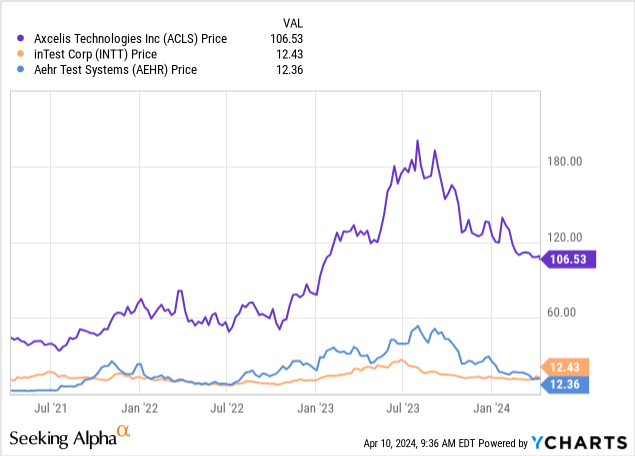

Chart 7 illustrates the performance of ACLS, INTT, and AEHR. We see the impact on share performance due to the slowdown in SiC for these three companies. All companies peaked in mid-2023, in concert with my December 23, 2023 Investing Group article analysis noted above.

YCharts

Chart 7

These slowdowns are temporary, tied to a slowdown in EVs because of high prices, lack of infrastructure, manufacturing profit losses per vehicle, and reductions in government subsidies.

- Expanding beyond its foundational role in EVs and charging infrastructure, SiC is carving out significant niches across various sectors, owing to its superior efficiency and thermal performance.

- In the industrial realm, it’s revolutionizing motor drives and machinery with higher efficiency and resilience to high voltages.

- The renewable energy sector benefits from SiC in solar inverters and wind turbines, enabling more efficient power conversion.

- For power grid infrastructure, SiC facilitates high-voltage transmission and supports the advent of smart grid technologies.

- In the consumer electronics and computing fields, SiC improves power adapters, chargers, and data center efficiencies.

- In aerospace and defense, its high-temperature tolerance ensures reliability in critical applications.

This diversification not only broadens the scope of SiC applications but also underscores its pivotal role in driving technological innovation towards a more energy-efficient future.

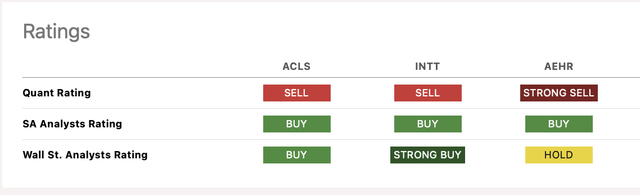

Chart 8 shows Quant Ratings for the three companies, with ACLS and INTT a Sell and AEHR a Strong Sell.

Seeking Alpha

Chart 8

I rate ACLS a Hold. Its performance has slowed due to the silicon carbide slowdown, but its main competitor AMAT also is impacted by the same issue.