Black_Kira

The Melt-up

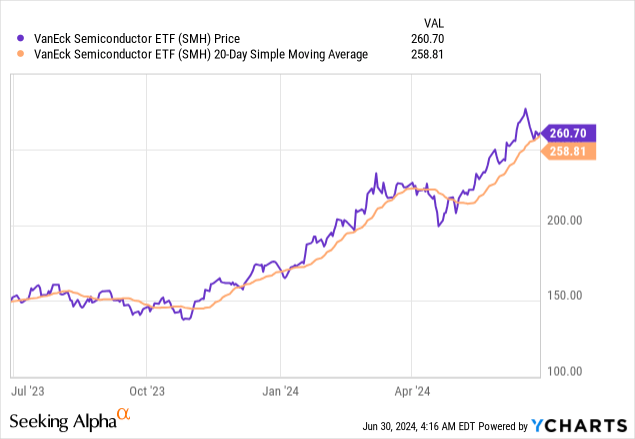

The negative fundamentals and deteriorating technicals were already evident for the Semiconductor ETF (NASDAQ:SMH) in March, when I recommended a sell. The price significantly corrected over the next month.

However, instead of a deeper correction, the semiconductors burst higher into the melt-up. The main reason for this melt-up was the stock split for Nvidia (NVDA) and Broadcom (AVGO), which caused massive retail investor excitement and inflated the bubble.

However, as I will explain, this bubble is likely in the process of bursting, and thus, the recent technical dip is likely to extend into a much deeper drawdown.

The Semiconductor ETF SMH reached its peak on June 20th, and since it fell to the first technical support at the 20dma, as the chart below shows. The technical breakdown below the 20dma support could accelerate the selling – and thus, induce the Gen AI bubble burst.

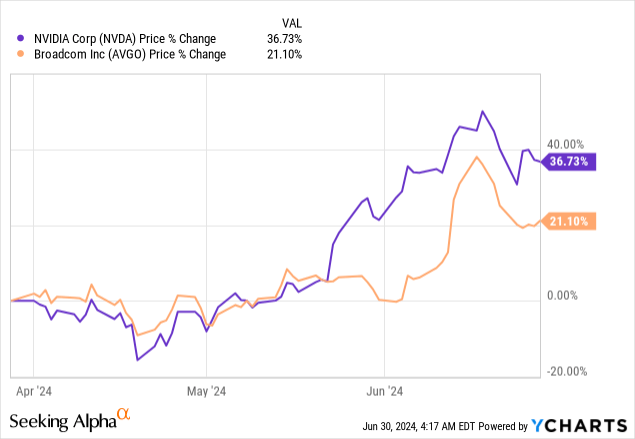

The chart below shows first the Nvidia spike after the announced 10-1 stock split, and then the Broadcom spike also after the announced 10-1 stock split. Since the June 20th top, both stocks have been in a downtrend.

The bearish case

Broadcom already warned in March that “there is no tangible business case for enterprise AI”. .

The other market is on the enterprise side, which could be cloud or on-prem. In this space, a lot of people are trying to invest in AI, but to be honest with you, the business case is yet to be proven. I think there’s lots of initiatives, AI initiatives. I’ve spoken to several CIOs yesterday. It’s still wait and see. Each of these folks are building small clusters to trial these. Even the cloud guys are trialing some, but there is no real tangible business case as we see on the consumer AI.

In fact, Broadcom warned that “there are lots of AI initiatives” but that it’s “still a wait and see” game. The clear implication is that the Gen AI Capex spending could slow and fail to meet exuberant expectations – if some of these AI initiatives are not implemented.

So, that’s the bearish case for the semiconductor stocks (that are closely affected by the Gen AI spending) – the Gen AI Capex is likely to slow, which will burst the Gen AI hype, and thus, burst the Gen AI bubble, given the extraordinarily high valuation multiples of selected individual semiconductor stocks, like Nvidia.

The recent survey supports the bearish case

The recent survey by Lucidworks (June 2024) finds that “applying the technology has presented some unexpected challenges, including dangerous hallucinations and incredibly high implementation costs. In 2024, business leaders are slowing down spending to balance the benefits, costs, and risks of this relatively new technology”.

This key finding essentially supports the bearish case for the Gen AI related stocks, as discussed above.

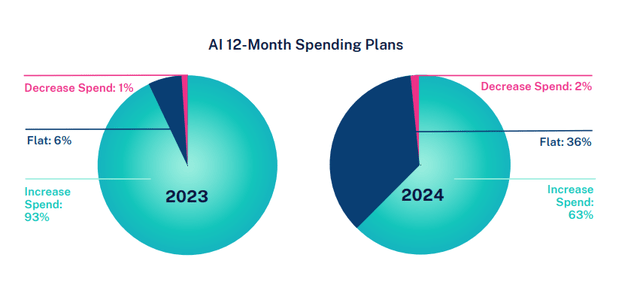

Specifically, the Lucidworks survey finds that, while in 2023, 93% of companies surveyed expected to increase the spending on Gen AI, only 63% of companies expected to increase spending in 2024. This is a significant decrease.

The survey also finds that “the financial benefits of implemented projects have been dismal”.

- 42% of companies have yet to see a significant benefit from their generative AI initiatives.

- Thus, only 25% of planned generative AI investments have been fully implemented so far.

This is actually the biggest worry for supporters of Gen AI – that Gen AI fails to provide any financial benefit for the adopters. But, that’s exactly what is happening, based on the survey.

The Lucidworks survey concludes:

The initial wave of enthusiasm for generative AI is being met with a more strategic approach. Businesses are recognizing the potential of this technology, but they’re also cautious about the risks and costs. This is reflected in the flattened spending, which suggests a shift toward more thoughtful planning. This planning ensures that AI adoption delivers real value, balancing the need to stay competitive with managing costs and potential risks.

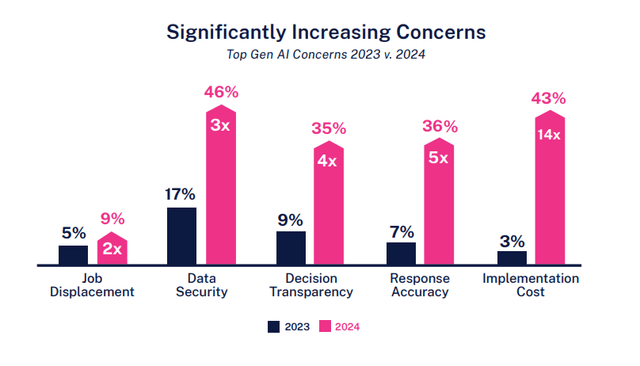

Other than the lack of financial benefits, the firms surveyed are having “significantly increasing concerns” about the Gen AI adoption, relative to the 2023 survey.

Most notably,

- 43% of surveyed firms are concerned about the implementation cost in 2024, compared to only 3% in 2023.

- 36% of survey firms are concerned about the response accuracy, compared to only 7% in 2023 (hallucination concerns).

It seems like the Gen AI adoption does not really increase revenues, it’s very costly to implement, and on top of that, might not even work correctly.

SMH implications

VanEck Semiconductor ETF (SMH) is heavily vulnerable to the Gen AI bubble burst because Nvidia accounts for 20% of the ETF holdings, Taiwan Semiconductor Manufacturing Company (TSM) accounts for 13%, while Broadcom counts for 8%. These three stocks account for 40% of the fund, and all of them are significantly overvalued.

Nvidia is trading at a PS ratio of 38, that’s extremely overvalued. Broadcom is trading at a PS ratio of 16, while TSM is trading at a PS ratio of 11. Just for comparison, Intel (INTC) has a PS ratio of 2.36.

Thus, the three largest semiconductor stocks have bubble-like valuations, and account for over 40% of the SHM fund.

Obviously, these three semiconductor companies have high multiple valuations due to the extremely optimistic expectations about future growth. However, based on the Lucidworks survey, the Gen AI technology is facing significant implementation issues, and, thus, these “lofty” expectations are unlikely to be met, as the GenAI capex spending is expected to slow.

As a result, in my opinion, the valuation multiples have to contract, which could mean a 60-80% price collapse for SMH – which is what usually happens when the bubble bursts, based on the 2000 dot-com bubble experience.

Other than issues with the Gen AI implementation, the semiconductor industry is also facing a likely recession, and we know that the semiconductor industry is highly cyclical.

Thus, my rating for SHM is a Strong Sell.

The upside risk is still related to timing, and the bubble could reinflate if the Fed once again turns dovish, although it seems like it is too late for this, as the recession is likely imminent, and the first Fed cut is likely to come in response to a recession – which will be negative for the broad stock market.

The industry-specific risk to the sell thesis is also the potential development of a “killer-app” for consumer and enterprise Gen AI case, which could accelerate the Gen AI adoption. Obviously, this could extend the current Gen AI capex spending and continue to boost SMH.