zorazhuang

Investment Thesis

As the second-largest semiconductor ETF after the VanEck Semiconductor ETF (SMH) and with $15b in AUM, the iShares Semiconductor ETF (NASDAQ:SOXX) is a household name. I think the ETF is a very good vehicle for investors who are not very knowledgeable about the sector and are ready to take mild levels of risk, which are inherent to the industry, to gain adequate exposure to the semiconductor industry.

The Semiconductor Industry

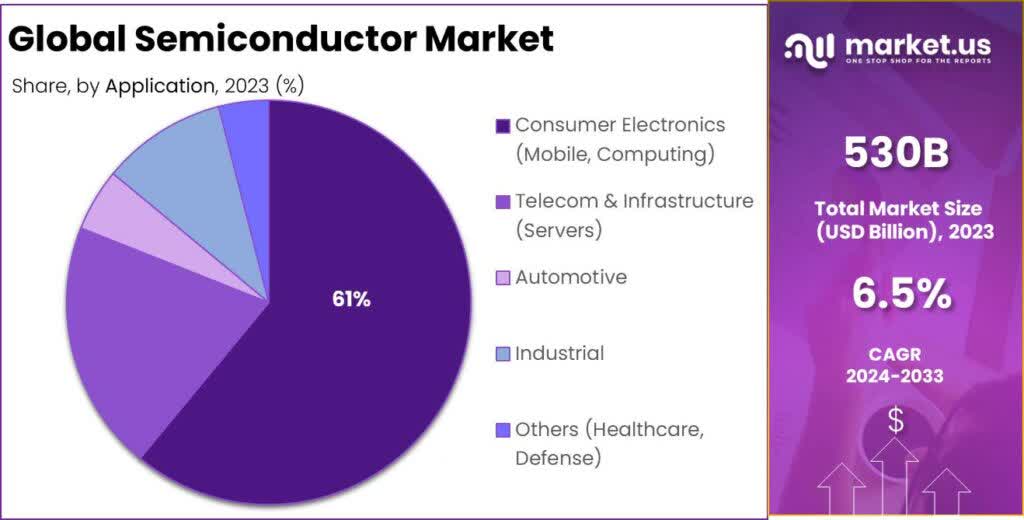

As semiconductors are in every piece of technology we currently use, it is one of the most important industries in the world. As the volume and the complexity of chips have and are projected to increase, demand for all participants increases. This is supported by technological advancements in every sector. Illustrative examples include anything from medical technology, robotics, or automotive to mobile phones, telecommunication, and defense, which paints the growth runway for the broad semiconductor industry as extremely long and wide, even without AI.

The graphic shown is a bit conservative even in my opinion, with other estimates expecting a CAGR of up to 10% for the market.

Global Semiconductor Market By Semiconductor Application (market.us)

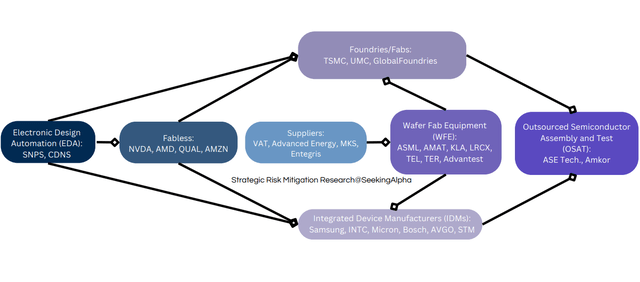

Just as complex as the millimeter-sized chips themselves, the industry is split up between many different players and has far more parts than just the well-known ASML’s (ASML) and Nvidia’s (NVDA):

Semiconductors Industry Overview (Author)

EDA is the software used by fabless Designers to design semiconductors. Following that, the chips are produced by Foundries, focused exclusively on chip manufacturing, and IDMs, companies that use chips in their products and also produce them themselves. To do this, they require specialized equipment for the many different production steps from other companies, which in turn need high-tech components to assemble their machines. These are manufactured by suppliers for the materials that go into the production process as well as specialized vacuum, sensor, or power components. Finally, many foundries and IDMs outsource the packaging and testing, the final steps before shipping, to other companies, so-called OSATs.

The ETF

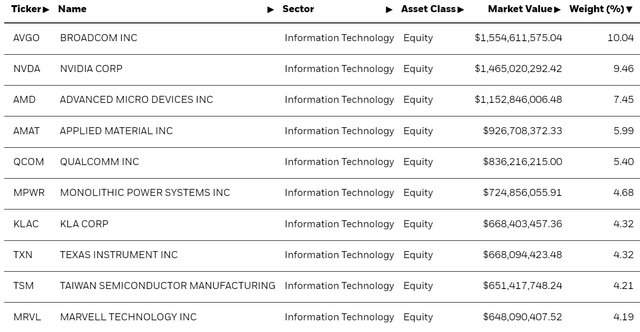

SOXX Top 10 Holdings (iShares/BlackRock)

Besides concentration being elevated I think this is a fine allocation, mainly as it is to be among the least concentrated semiconductor ETFs I could find. I particularly like that it doesn’t have Taiwan Semiconductor Manufacturing (TSM) and Nvidia weighted at double digits like other ETFs, as this decreases concentration and interdependency risk.

SOXX tracks the NYSE Semiconductor Index, which means its allocation should stay about the same in percentage terms, although its holdings might change over long timeframes. In my view, this is a positive.

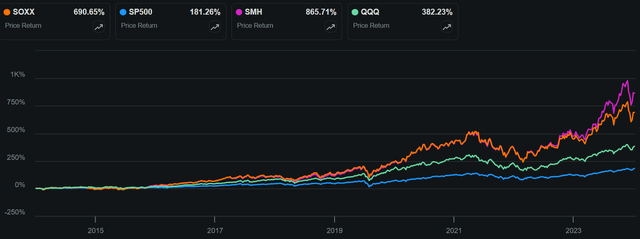

The ETF’s 10-year performance has been stellar, although not quite on par with SMH. Which has really only started to outperform after the October 2023 lows, most likely attributed to the massive NVDA rally.

SOXX vs SP500 vs SMH vs QQQ Performance Chart (Seeking Alpha)

SMH also carries much higher risk due to higher concentration and more exposure to geopolitical risk, additionally, major holdings depend on each other. Obviously, everyone likes to make money but to those who know the power of compounding, it is quickly apparent how much more important risk-adjusted (for me synonymous with predictability) long-term returns are. Performance is important, but risk management is more important in my opinion. That is why I would rather choose the outperforming “laggard” here.

I covered the risk SMH’s concentration poses in my last article titled “SMH: Extreme Concentration Makes It Unattractive“.

Risks

Geopolitical: A invasion of Taiwan would likely cripple almost the entire semiconductor industry. Besides Taiwan, South Korea, Singapore, and Malaysia are all manufacturing hotspots. While most are stable, especially South Korea could see increased risk, stemming from its northern neighbor.

Valuation: With a trailing twelve-month P/E ratio of 35, the valuation is almost 20% higher than that of the SP500. As valuation is synonymous with expectation, should the market rerate the sector, for example on increased risk or doubts about AI’s future, the entire sector could see a selloff. In the long term, this is a smaller risk for an ETF compared to stock picking in my opinion.

Cycles: The semiconductor industry is historically and projected to be cyclical, I don’t think this is a real risk for this ETF as demand recovery is a matter of time in my opinion. However, something to keep in mind, as I’ve seen too many inexperienced investors sell their positions at the bottom because it doesn’t perform for a couple of quarters, just to see it race up.

Possible Downside

After covering SMH in my last article, multiple readers claimed that SMH will keep its outperformance up SMH as it has for the last decade, which is definitely possible. However, I think some might take the downside too lightly. That is why I will shine more light on, in my opinion, the worst-case scenario here, to hopefully illustrate the risk more clearly. This is just as important for (potential) SOXX investors to be aware of.

The absolute worst-case scenario I can imagine is a Chinese invasion of Taiwan and a complete loss of its wafer capacity. Not only would most companies lose a significant part of their revenue, due to likely sanctions and/or trade restrictions hitting China. But it would also mean TSMC might lose up to 83% of its total capacity, which NVDA, among others, is dependent on.

For example, ~35% of Broadcom’s (AVGO) 2023 revenue depends on China. While this is true for 38% of Nvidia’s 2024 revenue (combining revenue from China + Taiwan), Nvidia would also lose the vast majority of its, or rather TSMC’s, production facilities.

TSMC’s current capacity is at about 16 million wafers a year, or 1.2m a month. With the currently planned fabs in Japan, Dresden, and Arizona adding a potential combined 160.000 monthly capacity, TSMC will still rely on Taiwan (and the fabs located in China) for a majority of their total capacity. Taking TSMC Washington’s 40.000 monthly capacity into account, this amounts to a monthly capacity of 200.000, or 17%, of their total capacity which would be unaffected by an invasion. Keep in mind, that the second half of Japan’s capacity, as well as the entirety of Dresden and Arizona, still have possibly years until ramp up.

Overall, I would estimate a possible downside of over 50 percent for the entire sector and the ETF, based on the current holdings. Companies like AVGO, Applied Materials (AMAT), KLA (KLAC), and Texas Instruments (TXN) should help in isolating a bit against this, as they either have fabs outside of China or have less of their revenue dependent on China. This is why I personally hold WFE companies. Still, I see a possible downside beyond 30% for this group of indirectly exposed companies should the mentioned risks materialize.

And while I don’t think this is very likely to happen, I want to make investors aware of it, as I have seen many blue-eyed assumptions about the risks. So while I see a bright future for semiconductors, this is the major reason why I’m very skeptical of SMH and its very heavy weighting towards NVDA and TSMC. And consequently more inclined to SOXX’s more balanced approach.

Conclusion

The takeaway depends on your knowledge as well as your risk appetite.

I do think there are better ways to get exposure to the semiconductor industry with less risk for advanced investors. Namely, picking specific stocks, and mitigating risk by knowing exactly which exposure one has. While still positioning your portfolio in a way that allows it to participate in any future technological advancements that semiconductors will most likely be part of. I will likely cover companies I see as suitable for this soon and personally hold KLA and TER.

Investors less knowledgeable or with limited time for research and a mild appetite for risk, are likely going to get nice risk-adjusted returns with SOXX as part of their diversified portfolio, supported by long-term industry tailwinds, which is why I rate it a buy for this investor group.

![[VIDEO] Business Benefits In Minnesota, a Polar Semiconductor Perspective [VIDEO] Business Benefits In Minnesota, a Polar Semiconductor Perspective](https://i2.wp.com/businessfacilities.com/wp-content/uploads/2024/11/emt-minnesota-state-of-the-north-video-promo-2.jpg?w=428&resize=428,400)