Taiwan Semiconductor Has Soared 96% But Geopolitical Risks Persist – Taiwan Semiconductor (NYSE:TSM)

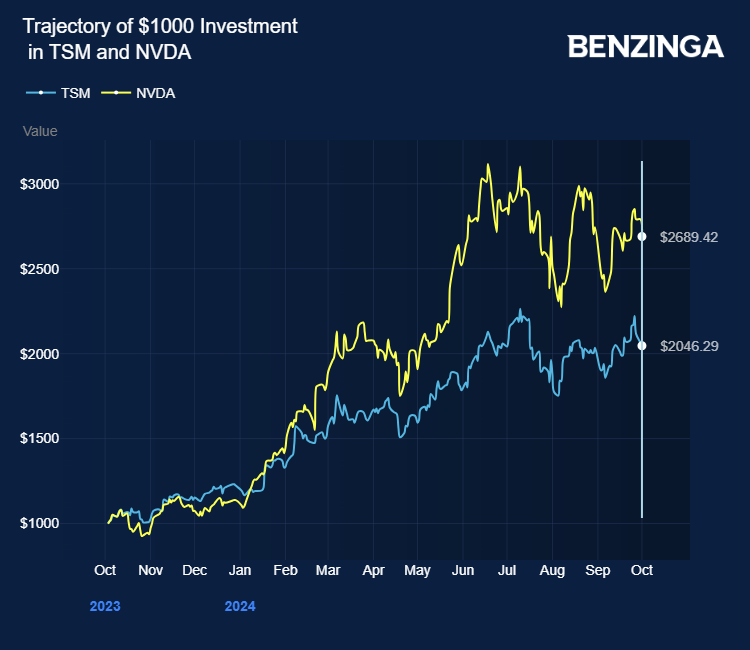

Taiwan Semiconductor Manufacturing Co TSM stock has gained over 96% in the last 12 months, as the hyperscalars’ artificial intelligence ambitions translate into higher demand for AI chips from companies like Nvidia Corp NVDA.

Recently, Taiwan’s National Science and Technology Council (NSTC) Minister Wu Cheng-wen flagged Taiwan Semiconductor’s 2-nanometer technology, which puts it ahead of China by at least a decade.

Taiwan Semiconductor aims to develop 2nm chips in at least 2 U.S. fabs. Its overall investment in Arizona exceeded $65 billion.

Also Read: Despite Nvidia Selloff, Biden’s Law and Taiwan Semi’s Advantage Offer Growth Potential

Bloomberg reports that Taiwan Semiconductor accounts for 36% of Taiwan’s index weighting. According to Bloomberg, exchange-traded funds will likely keep retail and institutional investors hooked, driven by the demand for AI applications.

Despite tailwinds, Taiwan Semiconductor is susceptible to geopolitical risks and rising tension between the U.S. and China.

Chinese leader Xi Jinping reiterated his commitment to “reunification” with Taiwan on the eve of China’s 75th anniversary, CNN reports, implying that geopolitical tensions will persist.

On Sunday, U.S. President Joe Biden approved Taiwan’s $567 million military aid package.

For context, the U.S. sanctions on China forbid the Asian counterpart from importing Nvidia artificial intelligence chips.

Although China’s Communist Party has never governed Taiwan, it claims the self-governing democracy as its own. Since the end of the Chinese civil war in 1949, China and Taiwan have been ruled by separate governments.

Investors can gain exposure to the semiconductor ETF through the First Trust Nasdaq Semiconductor ETF FTXL and the EA Series Trust Strive US Semiconductor ETF SHOC.

Price Action: TSM stock is up 0.57% at $173.05 premarket at last check Wednesday.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.