These Analysts Revise Their Forecasts On ON Semiconductor After Q3 Results – ON Semiconductor (NASDAQ:ON)

ON Semiconductor Corp ON posted better-than-expected earnings for the third quarter on Monday.

The company posted a revenue decline of 19.2% year-on-year to $1.76 billion, beating the analyst consensus estimate of $1.75 billion. The adjusted EPS of 99 cents beat the analyst consensus estimate of 97 cents.

CEO Hassane El-Khoury said, “As power demands continue to rise across our key markets, and the need for greater efficiency becomes paramount, we are investing to win across the entire power spectrum to ensure that onsemi is best positioned to gain share in automotive, industrial and AI data center.”

ON Semiconductor expects fourth-quarter adjusted revenue of $1.71 billion—$1.80 billion, versus the consensus of $1.75 billion. The company expects adjusted EPS of $0.92–$1.04 versus the consensus of $0.97.

ON Semiconductor shares gained 1.4% to close at $72.24 on Monday.

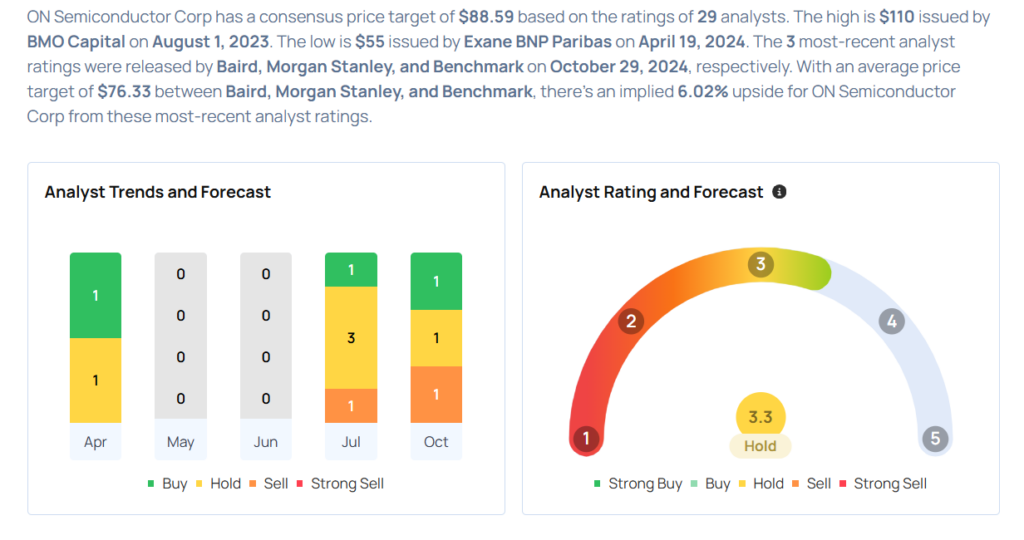

These analysts made changes to their price targets on ON Semiconductor following earnings announcement.

- Needham analyst Quinn Bolton maintained ON Semiconductor with a Buy and lowered the price target from $92 to $87.

- Morgan Stanley analyst Joseph Moore maintained the stock with an Underweight and raised the price target from $63 to $64.

- Baird analyst Tristan Gerra maintained ON Semiconductor with a Neutral and raised the price target from $70 to $75.

Considering buying ON stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.