The Indian automobile industry is vital to the nation’s economy, contributing around 7.1% to the GDP and employing nearly 19 million people. Two-wheelers predominantly dominate the sector and benefit from a growing middle class, a predominantly young population, and expanding opportunities in rural markets. The growth of logistics and passenger transportation fuels demand for commercial vehicles. Looking ahead, the industry increasingly emphasises vehicle electrification, particularly for three-wheelers and small passenger vehicles, which presents opportunities for innovation and sustainable growth.

India: A growing auto market and a rising exporter

Earlier this year, the Minister of Road Transport and Highways of India, Nitin Gadkari announced that India has become the world’s third-largest automobile market, surpassing Japan. The electric vehicle (EV) sector has experienced a remarkable 500% increase in sales from 2021 to 2023, with over 1.3 million EVs sold in the financial year 2024. This market is anticipated to grow at an annual rate of 50%, potentially reaching $7.09 billion by 2025. By 2030, India could represent a $206 billion opportunity in EVs, supported by $180 billion in investments.

Additionally, the India Brand Equity Foundation reports the passenger car market, valued at $32.7 billion in 2021, is also projected to grow at a CAGR of 9%, reaching about $54.84 billion by 2027, supported by government initiatives like the Automotive Mission Plan 2026 and the scrappage policy.

However, India also excels in heavy vehicle manufacturing, being the largest producer of tractors, the second-largest manufacturer of buses, and the third-largest producer of heavy trucks globally. In the financial year 2023, the country produced 25.9 million vehicles and exported 4.76 million vehicles.

Daimler India Commercial Vehicles (DICV), a renowned company in the sector, achieved its best performance in 2023 with sales of 23,400 trucks and nearly 2,000 buses, a 39% increase from the previous year. While domestic revenue grew by 21%, exports comprise about 35% of sales. The company exports brands like Fuso, Mercedes-Benz, and Freightliner to 60 markets.

In April 2024, Tata Motors saw substantial growth in its medium and heavy commercial vehicle segment, selling 13,218 units compared to 9,515 in April 2023. Total vehicle sales for the month reached 77,521, up from 69,599 a year earlier.

Rise of eCVs and cross-industry collaborations

India’s electric commercial vehicle (eCV) market surged 175.5% year-over-year, with 8,571 units sold. Tata Motors led the market with 5,590 eCVs, holding a 65% share, thanks to its diverse lineup, including electric buses and goods vehicles. The company’s significant contribution to sustainable transportation includes over 2,000 electric buses supplied across Indian cities.

“The two-wheeler market is at the forefront of India’s path towards EV adoption, with 35–40% electrification projected by FY31.”

Hemal N. Thakkar, CRISIL

JBM Auto and Mahindra Group followed in sales, reporting 530 and 515 units, respectively, highlighting strong demand for their electric buses and vehicles. Other key players included Olectra Greentech and PMI Electro Mobility.

Cross-industry collaborations are on the rise, such as Bajaj Auto’s partnership with Flipkart to deliver 1,000 electric cargo vehicles, supporting sustainable logistics. Meanwhile, Mahindra Last Mile Mobility has surpassed 200,000 EV sales, leading the L5 EV segment with a 41.2% market share, driven by products like the Mahindra Treo and e-Alfa.

Overall, India’s push towards electric and sustainable mobility is gaining momentum, driven by supportive government policies and a growing market base.

What’s fuelling India’s drive towards EVs?

Hemal N Thakkar, Senior Practice Leader & Director, CRISIL, projected that the two-wheeler market will lead the EV adoption and see 35–40% electrification by FY31, with scooters expected to lead this trend at over 60% due to competitive pricing and suitability for short commutes.

Ashish Pathak, Global Product Director, Digital & Supply Chain Practice at Boston Consulting Group (BCG), spoke about EV two-wheelers’ role in the growing e-commerce and intra-city delivery markets, noting their 100-kilometre range makes them ideal for urban use. Further, Harsimran Kaur, Researcher at ICCT (The International Council on Clean Transportation), emphasised corporate adoption, mentioning that companies like Zomato and Flipkart are at the forefront of corporate electric fleet commitments in India. The country also leads in new corporate EV deployments, and initiatives for electric buses have cut operational costs by 23%-27% compared to diesel buses.

“In India, EV adoption for passenger cars often hinges on peer influence and word of mouth.”

Ashish Pathak, Boston Consulting Group (BCG)

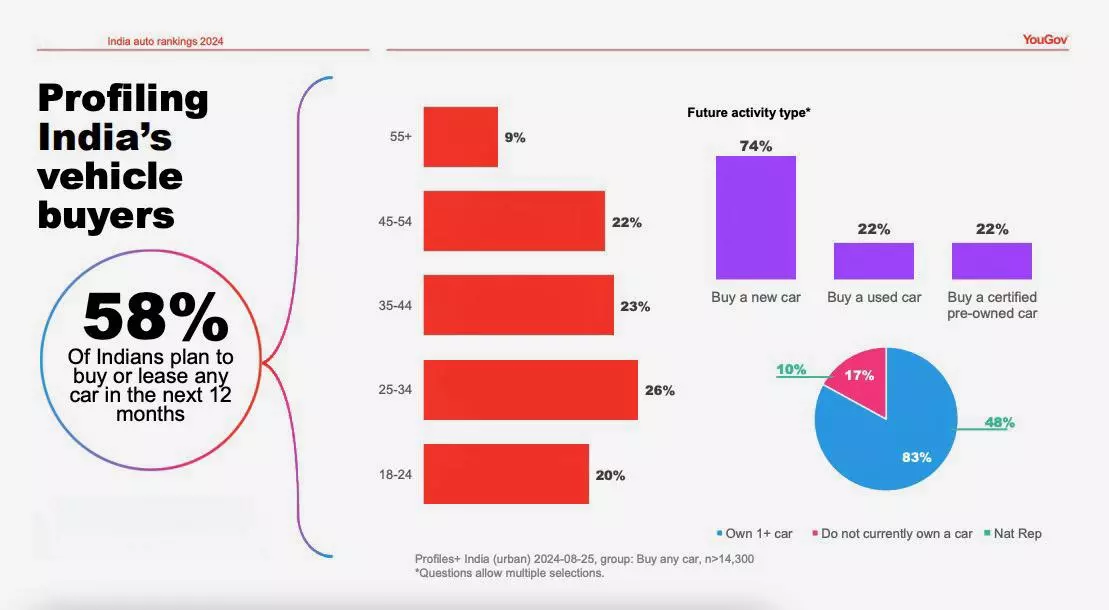

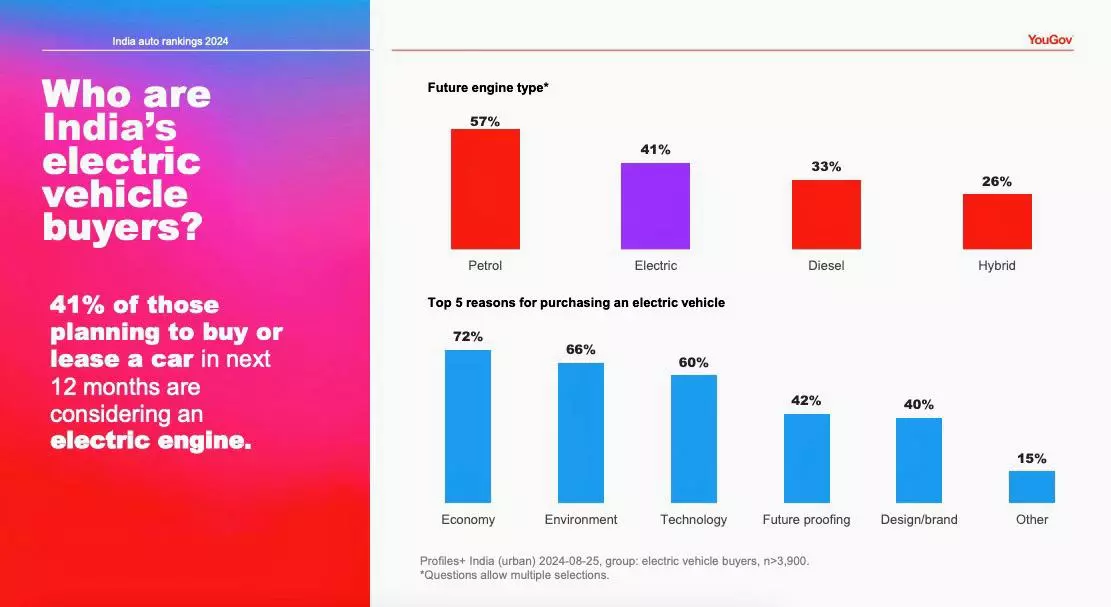

In contrast, motorcycle adoption is expected to grow slowly, with high single-digit penetration by FY31, reliant on affordable options from established brands. Meanwhile, a YouGov study (India auto rankings 2024), conducted in August 2024 revealed that 58% of Indians plan to buy or lease a car in the next 12 months, with 41% considering EVs, signalling a shift towards electrification in the automotive sector.

Talking about EV adoption trends, Thakkar mentioned he is also observing a lot of first-time buyers looking to buy EVs. So, EVs are no longer just secondary city cars; they are also becoming the primary car for many new car buyers in India. This view was not only agreed by many sector experts but also backed by consumer surveys.

In a discussion about India’s shift to EVs, Kaur referenced a McKinsey survey showing that over half of Indians are inclined to buy EVs as their next cars. The survey identified three main benefits of EVs: their environmental impact, lower ownership costs, and ease of driving. Kaur noted that EVs have fewer moving parts and are 70% to 85% more efficient than diesel vehicles, resulting in lower operating and maintenance costs.

Pathak from BCG highlighted that commercial vehicles are a promising area for EV innovation due to fewer size and design constraints, allowing for better integration of electric powertrains. He pointed out that these vehicles also have lower maintenance costs due to their simpler mechanics. While global automakers are investing heavily in this area, progress in India is slower, with companies like Ashok Leyland exploring both EV and hydrogen fuel technologies for commercial vehicles.

There are significant opportunities and challenges associated with the adoption of EVs in India. While there appear to be no inherent disadvantages for consumers, a major barrier remains the inadequate quality and insufficient charging infrastructure network. The McKinsey survey shows over 75% of consumers feel India lacks adequate charging points.

Looking ahead, passenger vehicles (PVs) are projected to see a 15–20% electrification rate by FY30, with anticipated momentum building significantly from FY27 as more manufacturers broaden their EV offerings. However, expert opinions diverge on the motives behind EV adoption.

Pathak mentioned that even though his opinion might vary from that of other experts, including those of other BCG staff, he personally emphasises the influence of cultural and social factors. “In India, EV adoption for passenger cars often hinges on peer influence and word of mouth. People buy because their friends or neighbours do, not necessarily because of a clear cost-benefit analysis,” he explains. However, this reliance on subjective motivations makes adoption fragile, as doubts about EVs’ real advantages could stall growth.

The adoption of EVs in India has been largely driven by government initiatives, particularly the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, which began in 2015. The second phase, launched in 2019 with a budget of ₹10,000 crore, has encouraged automakers to produce models eligible for subsidies, making EVs more appealing to consumers as their Total Cost of Ownership (TCO) becomes competitive with diesel vehicles.

Consequently, the share of EVs in total vehicle sales has risen from 1% in FY 2019-20 to an expected 7% in FY 2023-24, with three-wheeler electric sales increasing from 18% to 54%. While EVs gain traction, hybrid vehicles continue to serve as a temporary solution until charging infrastructure is fully developed.

“Electric vehicles have fewer moving parts and are 70%-85% more efficient compared to their diesel counterparts.”

Harsimran Kaur, The International Council on Clean Transportation (ICCT)

In the commercial sector, electrification is easier due to predictable travel ranges, particularly for buses, which are expected to achieve 15–20% penetration by FY30. Government policies, such as FAME subsidies, a 5% GST on EVs, and declining battery costs, play a critical role in this shift, supported by rising environmental awareness. Overall, the EV market is evolving rapidly, driven by innovation and consumer demand.

Competition from Chinese automakers

India’s transition to the BS6 emission norms, aligning with the Euro 6 standards, positions the country well in the global automotive market, especially in the EV sector. Both Thakkar and Pathak noted that the zero emissions from EVs enable India to avoid many regulatory challenges faced by internal combustion vehicles. This advantage is further enhanced by the global standardisation of EV emission norms, allowing India to export vehicles to developed countries without additional emissions tests, thus boosting its competitiveness.

However, challenges remain, particularly from Chinese competitors who dominate the EV market. Thakkar pointed out that China maintains an advantage in battery manufacturing and economies of scale, allowing it to maintain battery cell costs at $55-$70 per kWh compared to India’s $150-$200 per kWh. This pricing advantage is bolstered by China’s robust domestic EV market, where EVs constitute 20-25% of passenger vehicle sales.

Thakkar also highlighted that rising geopolitical tensions and tariff increases in markets like the EU and the US might drive China to seek alternative markets and reassess its pricing strategies, which could indirectly benefit India. He emphasised that India’s progress would depend on initiatives like KABIL to secure raw materials and invest in localised production and advanced technology.

Pathak further stressed the importance of creating a resilient supply chain for critical EV components, especially batteries and semiconductors, which India heavily imports from China. He recommended focusing on local manufacturing, diversifying supply sources, and utilising government initiatives such as the Production-Linked Incentive (PLI) scheme to bolster domestic supply chains.

Pathak also emphasised the role of digital transformation, with advanced analytics and AI helping predict and mitigate potential disruptions. He highlighted the growing frequency and impact of supply chain disruptions, such as those experienced during the semiconductor shortage, and stressed the need for proactive, dynamic strategies to address these challenges.

“Although the Indian EV market is growing, it has not yet reached the expected pace.”

Om Vijayvargiya, Schaeffler India

“Additionally, improving consumer awareness and investing in capacity building for EV maintenance will further enhance the ecosystem. With initiatives like PM E-DRIVE, which allocates ₹2,000 crore for charging infrastructure, there is a strong foundation to address these gaps and accelerate EV adoption nationwide,” added Kaur.

Impact of PPPs in India’s auto supply chain

Thakkar and Pathak both stressed the pivotal role of public-private partnerships (PPPs) in driving EV infrastructure development. Thakkar pointed out that over 75% of EV charging in India happens at home, with public fast-charging networks, particularly for buses and fleet vehicles, gradually improving. However, intercity travel still faces challenges due to limited charging infrastructure, with fewer than 200,000 EVs on the road, leading to low utilisation rates.

Thakkar emphasised that collaborations between manufacturers, charge point operators (CPOs), and state electricity distribution companies, such as Tata Power and MSEDCL, address the “chicken-and-egg” problem—where low EV volumes deter charging investments, while limited infrastructure restricts EV adoption. Thakkar believes these partnerships will become more refined over time, accelerating the expansion of charging infrastructure as EV penetration grows.

Echoing Thakkar’s sentiments, Pathak emphasised the need for regulatory stability from governments while private players focus on innovation and infrastructure investment, particularly in charging stations. He highlighted the importance of merging private investments with government initiatives to establish uniform safety standards and meet urban needs aligned with sustainability goals.

Kaur from ICCT pointed out the government’s essential role in providing funding, policy frameworks, and incentives to reduce financial burdens on private entities, bringing innovation and market efficiency. She referenced successful partnerships in India, such as Indian Oil and Bharat Petroleum, which installed over 7,000 fast-charging stations.

“Our WMS enables clients to adapt to demand shifts, effectively preventing overstocking and shortages.”

Nikhil Agarwal, CJ Darcl Logistics

Kaur noted global examples from France and the UK, where government incentives and private collaboration have addressed charging infrastructure gaps. She mentioned how policies like the FAME II scheme have made EVs more competitive, alongside state policies that lower the total cost of ownership. Initiatives like PM E-DRIVE have increased consumer confidence, while stricter fuel economy regulations could further push EV production and help India achieve its EV and carbon reduction targets.

But are all stakeholders prepared for the change?

While OEMs increasingly boost production to meet consumers’ increasing demand for EVs, are component manufacturers and logistics players prepared for the change?

In response to the shift toward EVs, Om Vijayvargiya, Head of Supply Chain Management and Logistics at Schaeffler India, confirmed that the company has already integrated EV products into its global portfolio and is ensuring the supply of EV components to meet the increasing demand.

Discussing the rising need for EV-specific materials such as lithium and cobalt, Vijayvargiya stated, “Although the Indian EV market is growing, it has not yet reached the expected pace. While the year-over-year growth percentages may seem significant, the absolute numbers are still relatively small. We anticipate that it will take a few more years for the market to gain substantial momentum.” He further explained that the current challenges in supplying EV components are similar to those faced in traditional internal combustion engine (ICE) components.

The increasing demand for EV-specific materials poses challenges not only for component manufacturers but also for logistics service providers. Nikhil Agarwal, President of CJ Darcl Logistics, discussed the logistics difficulties of transporting EVs and their components, particularly batteries. He explained, “EV batteries are large, heavy, and classified as hazardous materials, requiring specialised handling and transportation protocols to ensure safety.”

However, technology is a key solution to many challenges faced in the automotive supply chain. Arshdeep Mundi, Executive Director of Jujhar Group, emphasised the role of technology in maintaining safety and efficiency in fleet operations. “We use GPS systems, live camera monitoring, and Management Information Systems to ensure optimal fleet utilisation and safety standards,” he said.

Mundi added that automation is transforming the supply chain by reducing costs, improving service quality, and minimising logistics time. He noted that robotics and artificial intelligence (AI) are revolutionising assembly and storage processes, while multi-modal logistics—integrating road and rail—enhances operational efficiency for both domestic and export transportation. “Integrating multi-modal logistics, such as road and rail, significantly enhances operational efficiency for transport within the country and for exports,” he added.

Agarwal further highlighted CJ Darcl also utilises AI and machine learning for precise demand forecasting, employing advanced systems like a cloud-native Transport Management System (TMS) and Warehouse Management System (WMS) for inventory visibility and operational efficiency. “Our WMS allows clients to adapt to shifts in demand, effectively preventing overstocking and shortages,” he added.

“Integrating multi-modal logistics, such as road and rail, significantly enhances operational efficiency for both domestic and export vehicle transportation.”

Arshdeep Mundi, Jujhar Group

On the other hand, Vijayvargiya discussed Schaeffler India’s proactive approach to managing market fluctuations and evolving consumer preferences, particularly the increasing demand for SUVs and compact cars. He explained, “In such a fluctuating market, it is crucial to build resilience into our supply chain to meet peak demand while maintaining tight inventory control during lean periods.” The company uses historical data and real-time monitoring to forecast seasonal trends and optimise production schedules. Addressing sudden demand spikes, he noted, “Air freight, while faster, also adds substantial additional expenses,” but advanced planning can help mitigate such challenges.

In conclusion, all industry leaders agree that technology-first strategies—ranging from AI-driven analytics to multi-modal logistics integration—are critical for enhancing supply chain resilience, efficiency, and sustainability.

To be a part of similar discussions and know more about the automotive supply chain management, REGISTER NOW to our flagship event – Auto SCM Summit 2024, scheduled for December 5th 2024 in Pune, India.